How to write a Journal entry for ATO tax payment (2022)

Local time 8:15 PM aest 27 April 2024 Membership 922,904 registered members 6,329 visited in past 24 hrs Big numbers 3,877,115 threads 74,042,330 posts 4,941 wiki topics

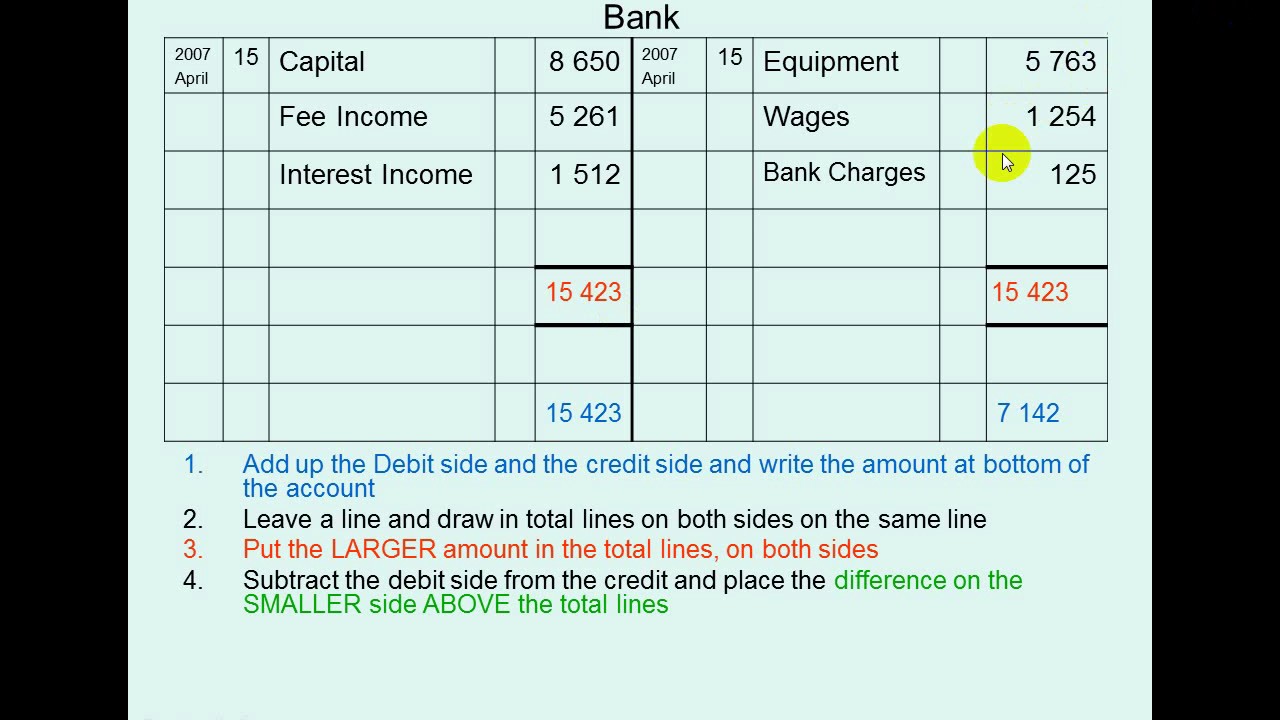

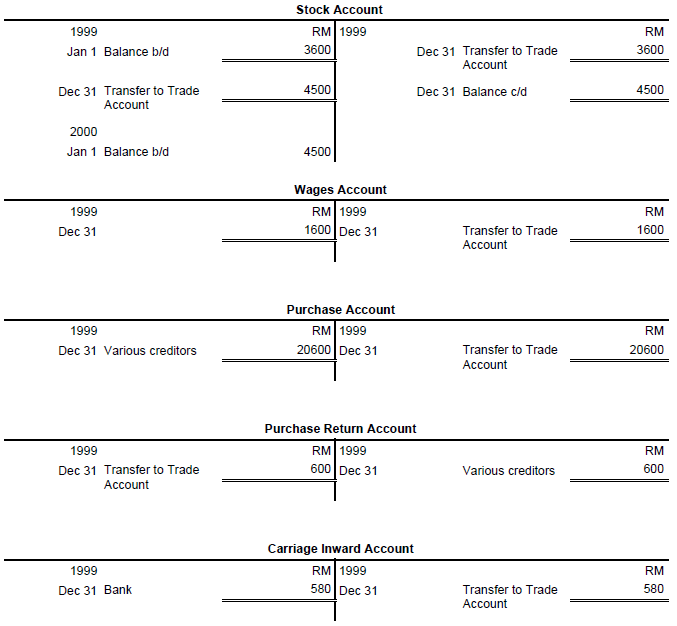

Assets Ledger account balancing Ledger Tutor's Tips

The manual review could be required due to an internal system issue impacting the calculations, or it could be due to a mismatch of the information that was provided in your tax return. Once its at the balancing accounts stage, that means that we're calculating your refund or bill depending on your account balance.

Ledger account balancing Ledger Tutor's Tips

how much you owe. the due date for payment. your payment reference number (PRN). Fully self-assessed companies and super funds don't usually receive a notice of assessment. Sole traders and partners in partnerships can check what income tax they owe through our online services accessed through a myGov account linked to the ATO.

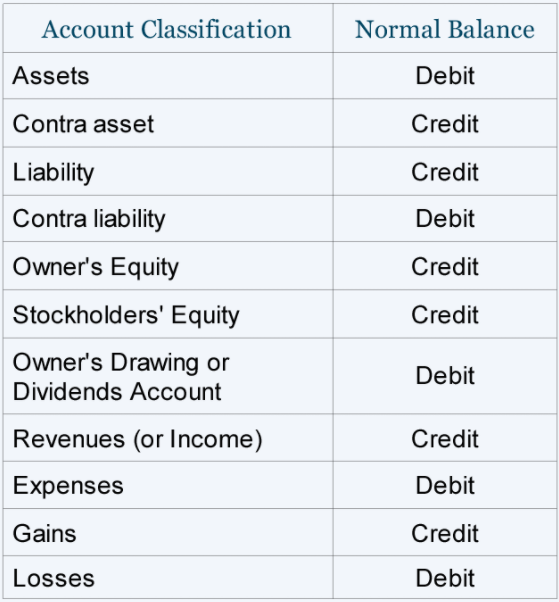

Normal balance definition and meaning SimpleAccounting

In Progress (Balancing Account) This is the step in the process where people know that money is coming their way. The ATO is calculating just how much is owed. In Progress (Processing) Like the previous status at the beginning of the process, information is being gathered. This time, it is in preparation to send over a refund. Issued (Total Amount)

Balancing Of Ledger Accounts Class 11th Class 12th Maharashtra www.vrogue.co

I stumbled into this place by accident and surprised to see so many people are experiencing the same pain. I submitted my tax return in mid October and still waiting endlessly! The status has been stuck in "balancing account' forever! Called ato once couldn't find an answer. I was told that someone was going to call me back, of course it.

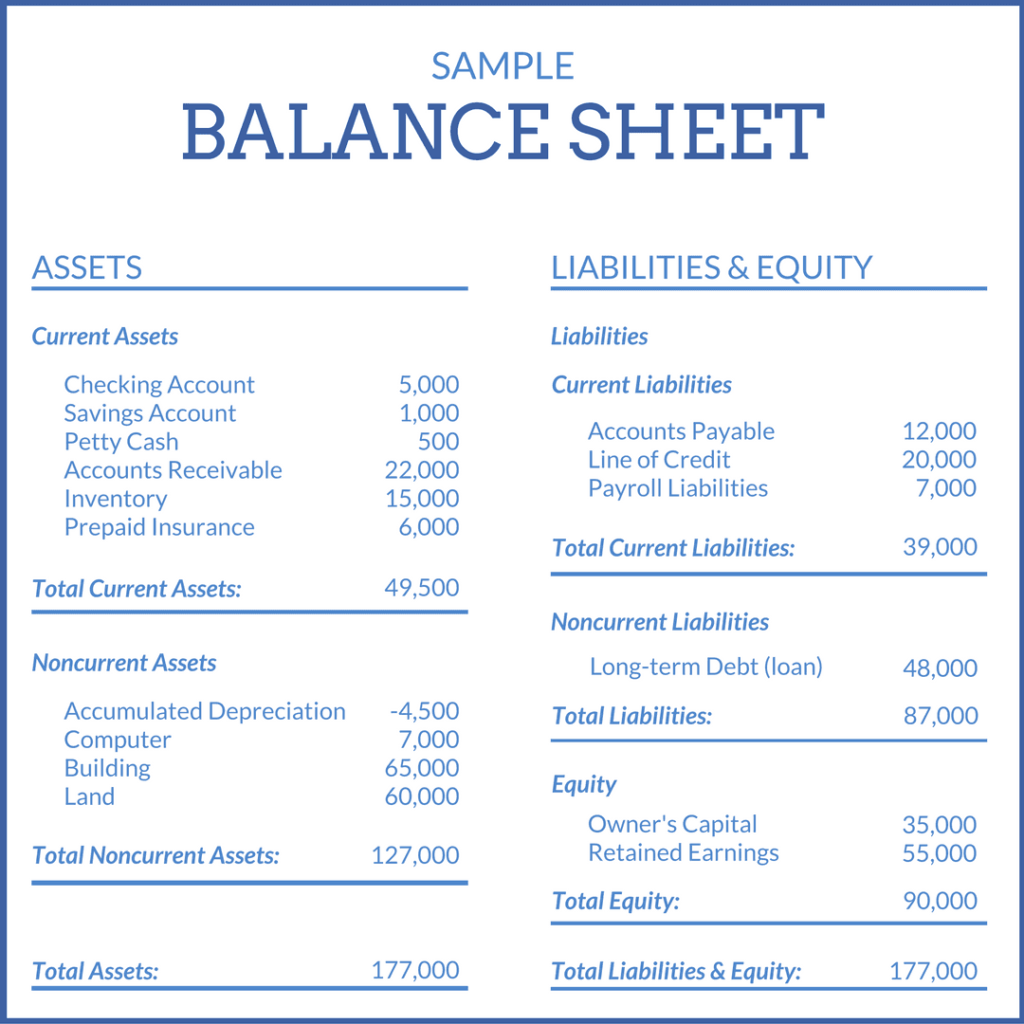

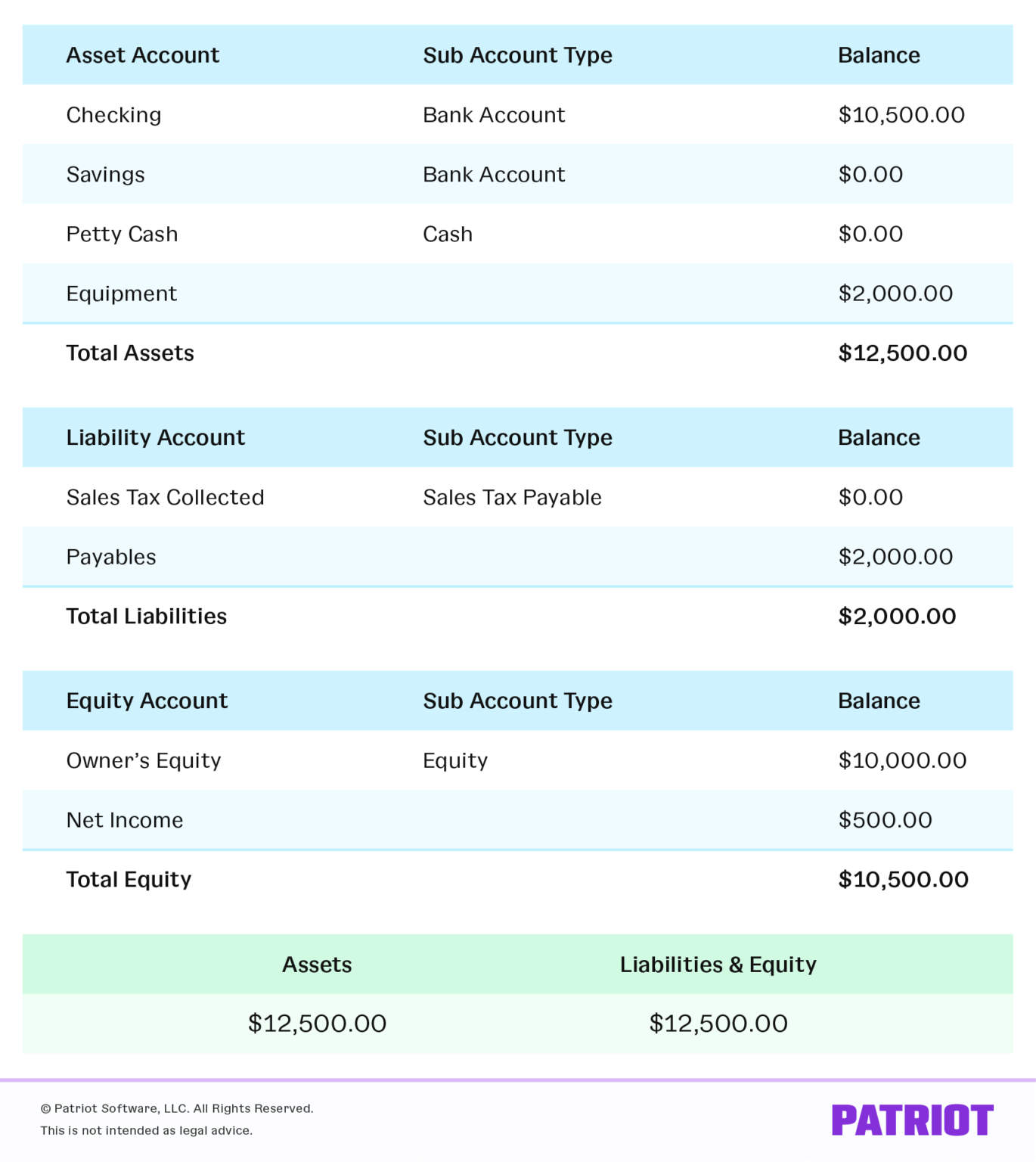

Balance sheet example Accounting Play

The ATO may contact you if they need more information. Balancing account ; Here the ATO will balance the result of your Tax Return with other government agencies so they can work out how much you need to pay, or how much you will be refunded. The ATO will contact you if they need more information. Issued ; This is the final stage.

Determining the normal balance and increase and decrease sides for accounts Chapter 2.1 YouTube

What is a Balancing Account ATO? A Balancing Account ATO, or Australian Taxation Office, is a financial tool integral to Australia's tax system. It serves as a reservoir for managing tax obligations. The Balancing Account helps taxpayers in Australia evenly distribute their tax payments throughout the year, avoiding the stress of lump-sum.

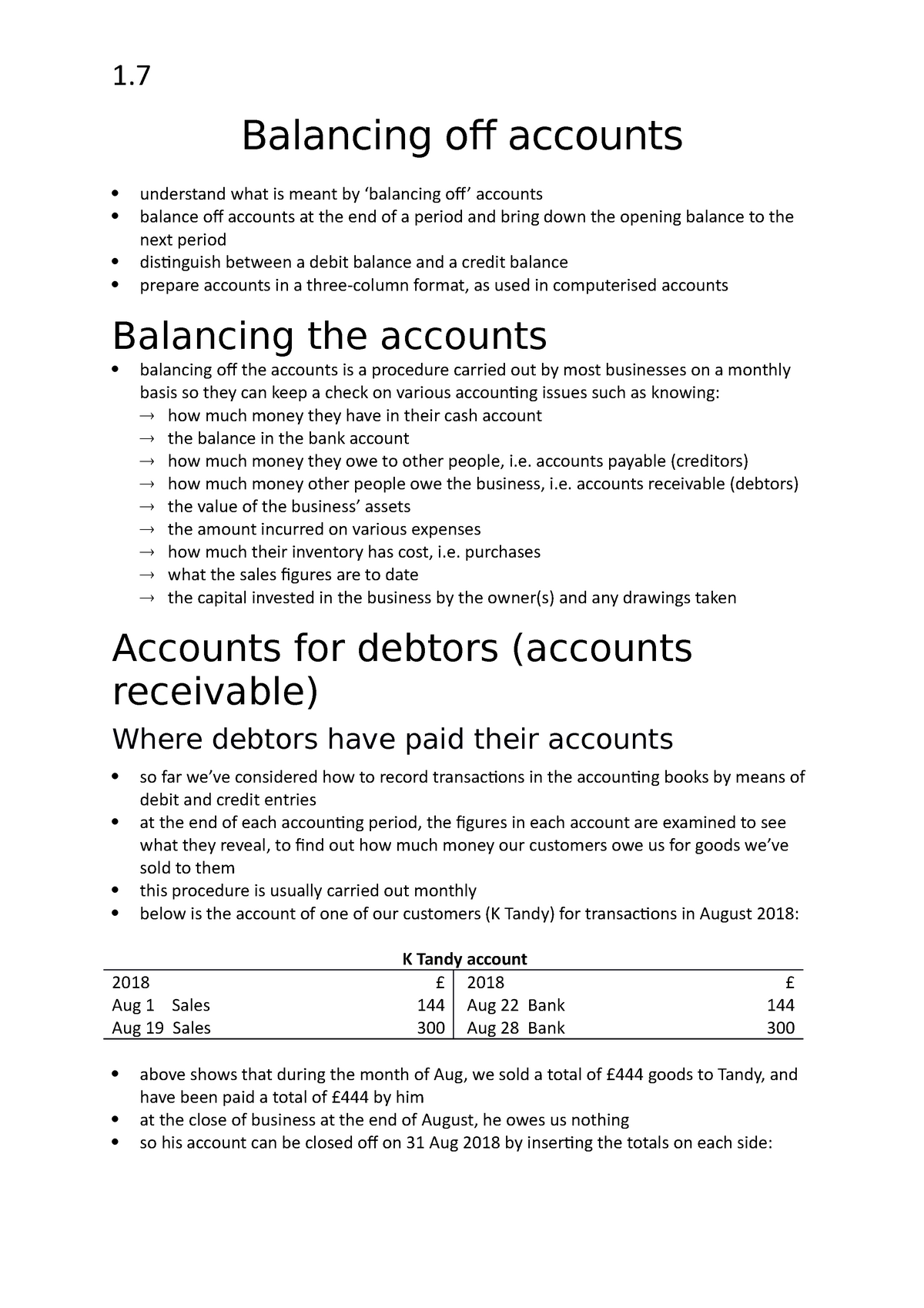

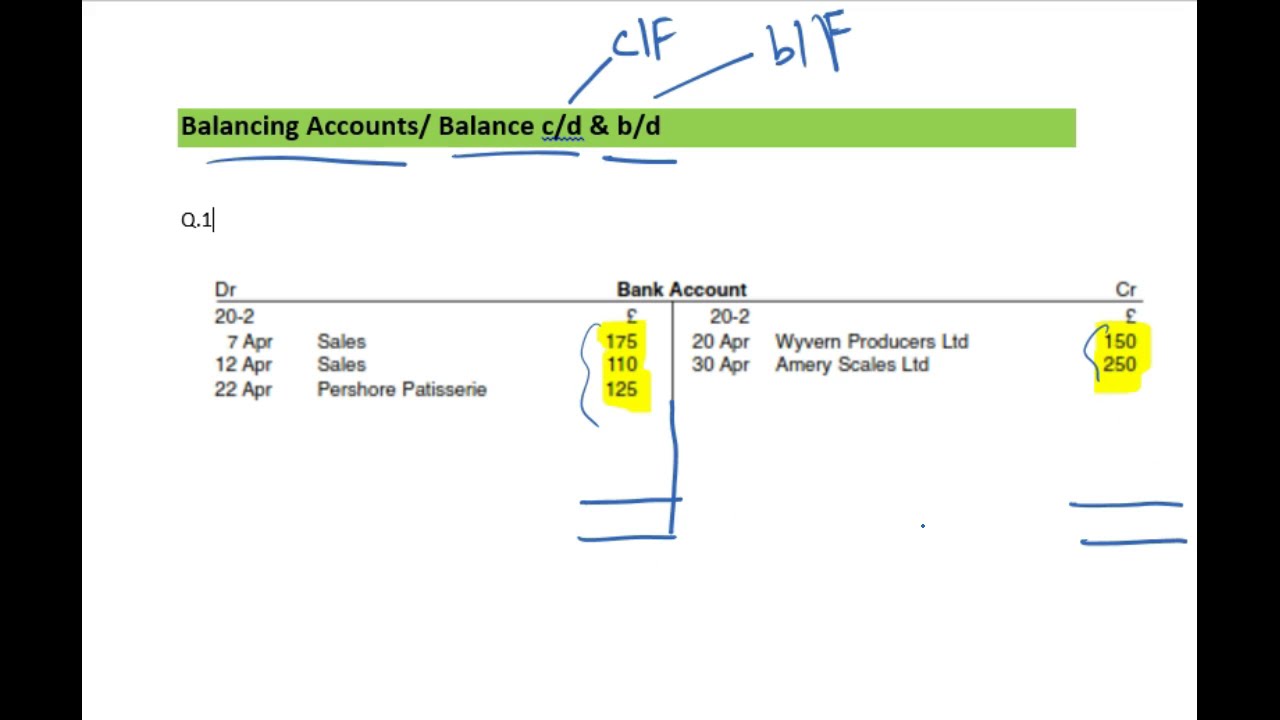

1.7 Balancing off accounts 1. Balancing off accounts understand what is meant by ‘balancing

The ATO is balancing the result of your client's tax return with their accounts with it and other government agencies and calculating the amount it will refund or that needs to be paid. The ATO will contact your client if it needs more information. Issued - $ amount. Client will be able to see their notice of assessment online, along with.

What Does a Balancing Account ATO Mean? TaxLeopard

The balancing account is the difference between the taxpayer's total income and total expenses. It is calculated by subtracting the total expenses from the total income. If the result of this calculation is a positive number, it will be added to the taxpayer's income, meaning that the taxpayer will pay more tax.

balancesheetexample

Balance account is simply that balancing all records before it's refunded back to you, minus any debt paid and if you paid less tax than you should have, then it will balance out from your expected refund to most likely a debt owed. Not sure how further clearer I can make it, but that is essentially what balancing means. 1. Reply. Share.

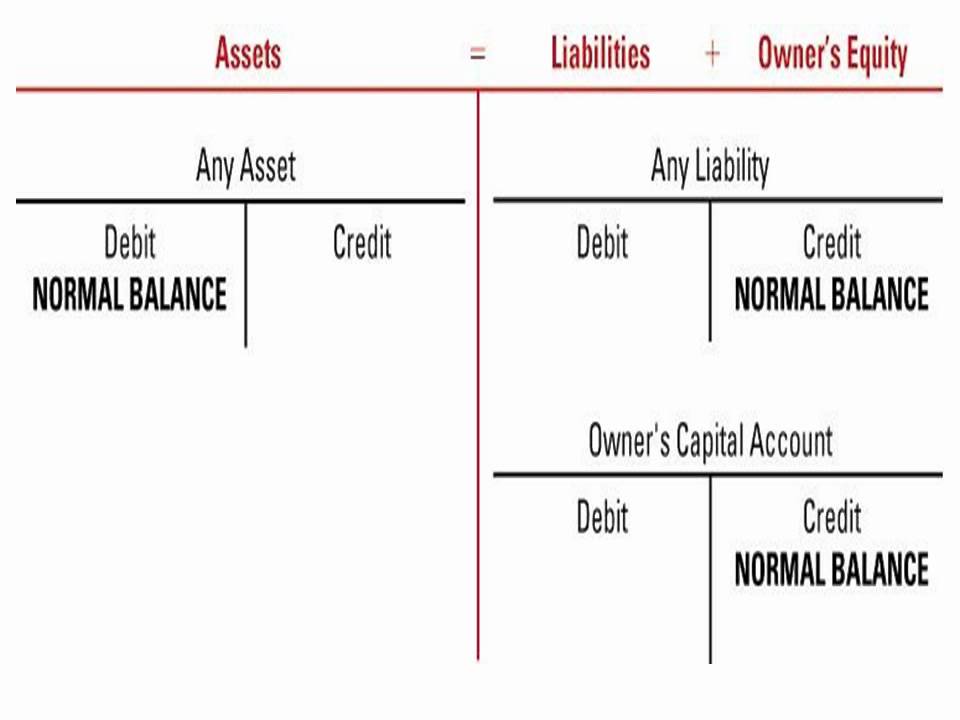

What Is the Accounting Equation? Examples & Balance Sheet

It acts as a reconciliation tool that helps the ATO identify discrepancies between your reported financial activities and their tracked transactions. The ATO uses the balancing account to calculate your tax liability accurately. This means that if there are any inconsistencies between your reported figures and the ATO's records, they'll make.

Balancing an account YouTube

reference: whrl.pl/RgywgB. posted 2023-Jan-16, 11:46 pm AEST. O.P. My tax return this year has been in 'Balancing Account' status for over 3-months, although the calculated outcome is a refund and the 'Effective Date' has already passed in November. I understand what the status means, but I have no HECS, Centrelink debts, never been insolvent etc.

Balancing And Closing Account Asia Bookkeeping

The ATO is focused on helping taxpayers get their deductions right, but they are also on the lookout for red flags that identify people who are doing the wrong thing. Not declaring income, over.

Account Balance Definition What is Account Balance? YouTube

ATO Assistant Commissioner Tim Loh explained that returns lodged in early July are more likely to be changed by the ATO compared to those lodged later. "While you can lodge from 1 July, there is a.

Ledger balancing or Closing of ledger account Ledger Tutor's Tips

Simply put, when the ATO tells you that they are balancing your account it means they have the information you provided for your tax return and they are now working out whether you are owed a refund or have a bill to pay. There are numerous statuses that the ATO uses throughout the tax submission process, you can find out more about what each.

Balancing Accounts (balance cd and bd) YouTube

Balancing accounts indicates that the ATO has the result of your return, and that it is calculating your refund (or bill) based on your account balance. The return may still take a few more days while it reviews your accounts with the ATO, but possibly also other Australian government agencies.

- Bjeshkët E Nemuna National Park

- A Deep Wave Sound Machine

- Little Bali Street Food Menu

- Stratford London To Central London

- Florence And The Machine Australia

- All Of Out Love Lyrics

- Small Over The Shoulder Purse

- Air Mauritius Perth To Mauritius Today

- How Old Is Someone Born In 1979

- Equal Opportunity Act South Australia