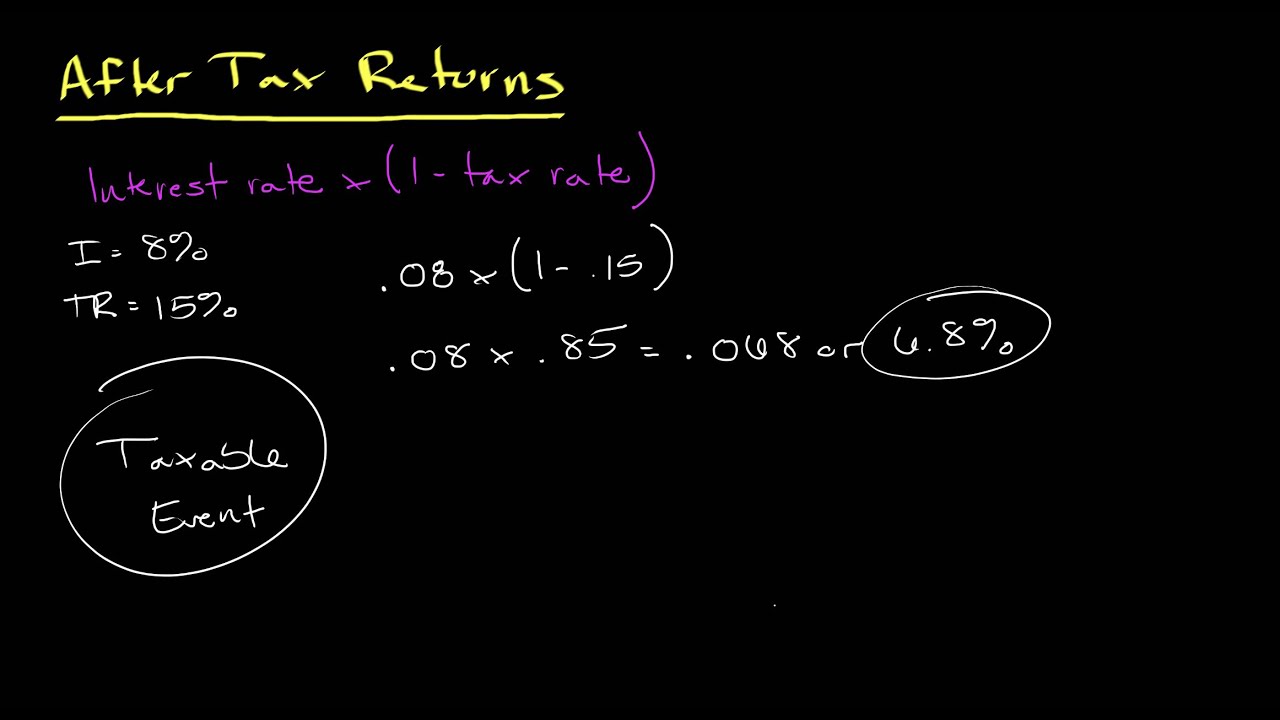

Calculating After Tax Returns Personal Finance Series YouTube

New tax rules for returns of capital. 09 November 2022. Tax Administration. Pieter van der Zwan. The National Treasury published the Taxation Laws Amendment Bill for 2022 on 26 October 2022. Amongst others, this bill includes an amendment that affects returns of capital. This is the outcome of a process that started in 2021.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns & Webber Estate Agents

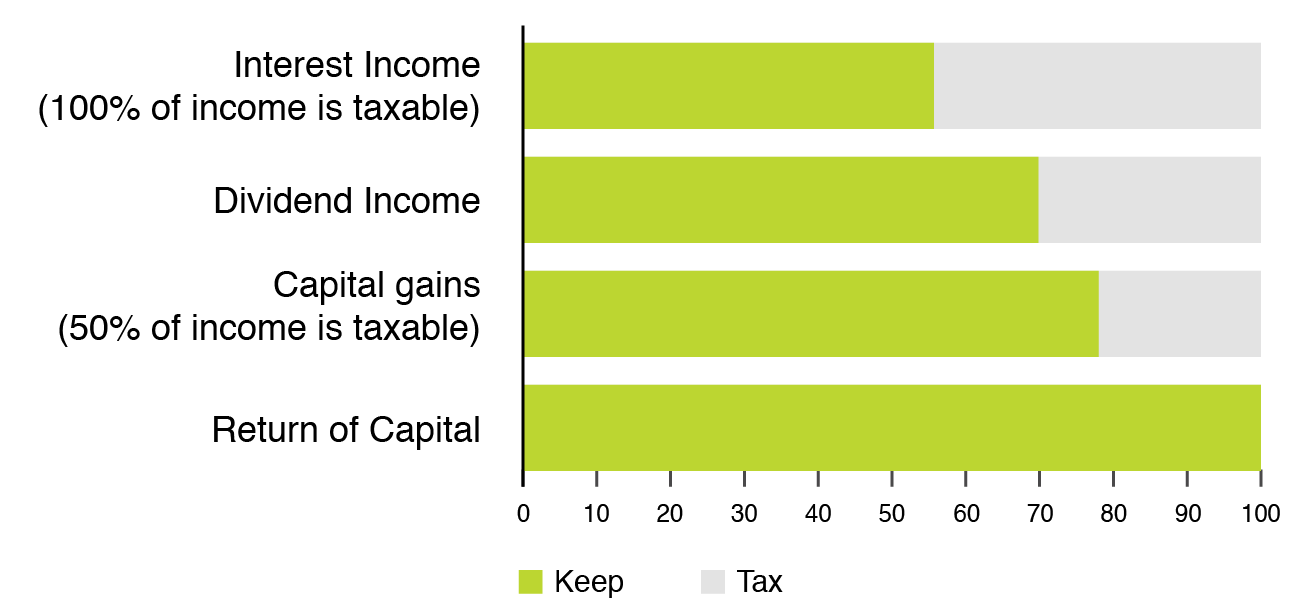

Tax rate assumptions (Ontario): 49.53% marginal income tax rate; 33.82% dividend income marginal tax rate; 24.77% capital gains marginal tax rate. Percentages have been rounded. 1As long as the adjusted cost base of the investment is greater than zero. Capital gains taxes may be payable when the units of a fund are sold or to some extent when their

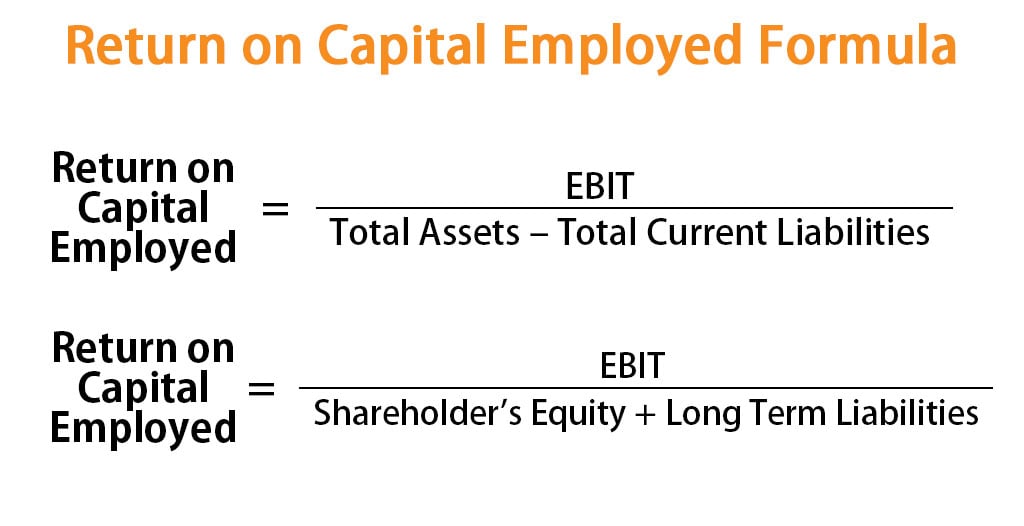

Return on Capital Employed Formula (ROCE) Calculator (Excel Template)

To establish a factual foundation for a "return-of-capital" theory, the Court stated, a taxpayer must show: " (1) a corporate distribution with respect to a corporation's stock, (2) the absence of corporate earnings or profits, and (3) stock basis in excess of the value of the distribution.". Taxpayer, the Court continued, failed to.

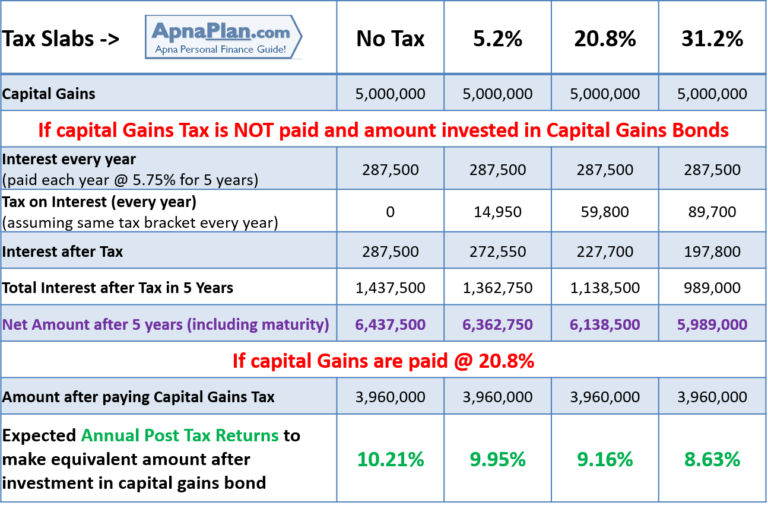

Should You Invest In Capital Gains Bond To Save Taxes?

Return of capital is a payment received from an investment that is not considered a taxable event and is not taxed as income. Instead, return of capital occurs when an investor receives a portion.

The Preferential Tax Treatment of Capital Gains Should Be Curbed, Not Substantially

Return of Capital Example. If you invested $10 in Company XYZ and received a $5 dividend that is a return of capital after one year, that $5 payment would be tax-exempt. If, however, you received a $6 dividend in the second year, for a total of $11 in return of capital, the amount that exceeds the original investment ($1 in this case) is taxed.

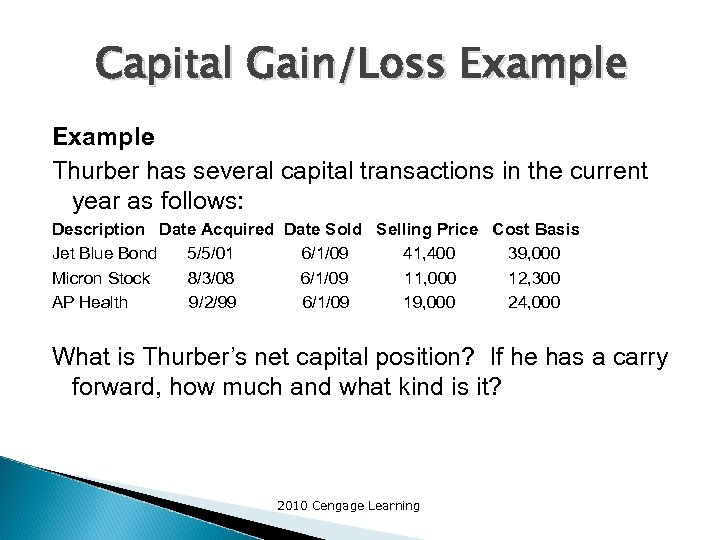

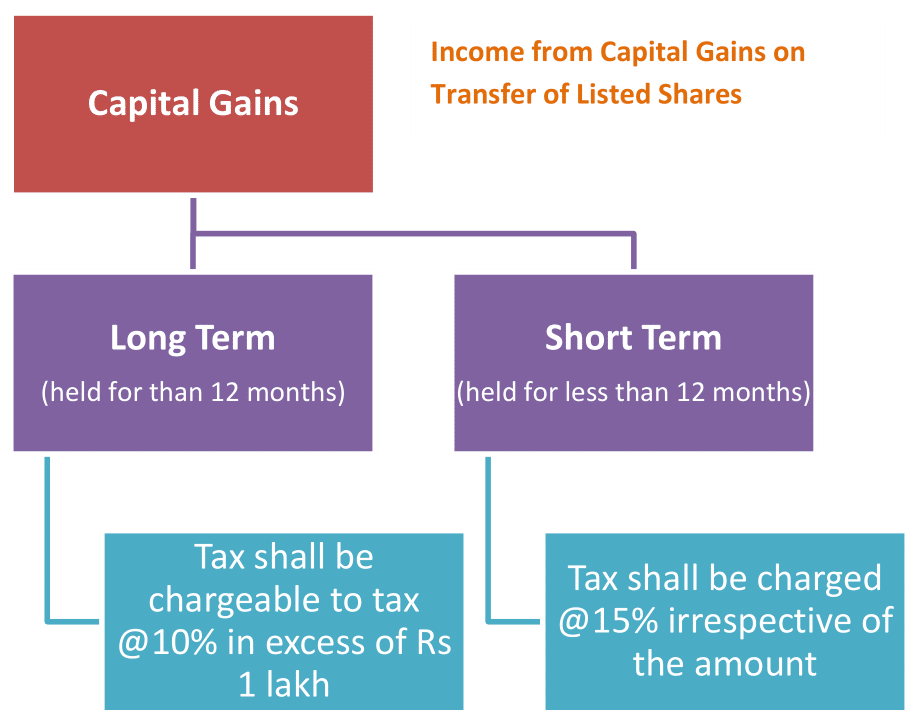

Tax treatment of capital losses BLP Legal

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 16 of Schedule D (Form 1040), Capital Gains and Losses. Claim the loss on line 7 of your Form 1040 or Form 1040-SR.

Chapter 8 Capital Gains and Losses Tax

Return of capital. Distributions that qualify as a return of capital aren't dividends. A return of capital is a return of some or all of your investment in the stock of the company. A return of capital reduces the adjusted cost basis of your stock. For information on basis of assets, refer to Topic no. 703. A distribution generally qualifies as.

How to disclose capital gains in your tax return Mint

There are two tax consequences. The capital return on your shares is a capital gains tax (CGT) event that may have resulted in a capital gain for you. Depending on the outcome, you may have to include some details on your 2004-05 tax return. As a result of the return of capital, you must adjust the cost base of your Promina shares.

Capital Gains Taxes Explained CWTA We're Here to Help

Tax Implications of Return of Capital Impact on Capital Gains Tax. ROC distributions are not immediately taxed as income. Instead, they reduce the cost basis of the investment. This can lead to larger capital gains when the investment is sold, resulting in higher capital gains tax. Tax Treatment of Excess ROC

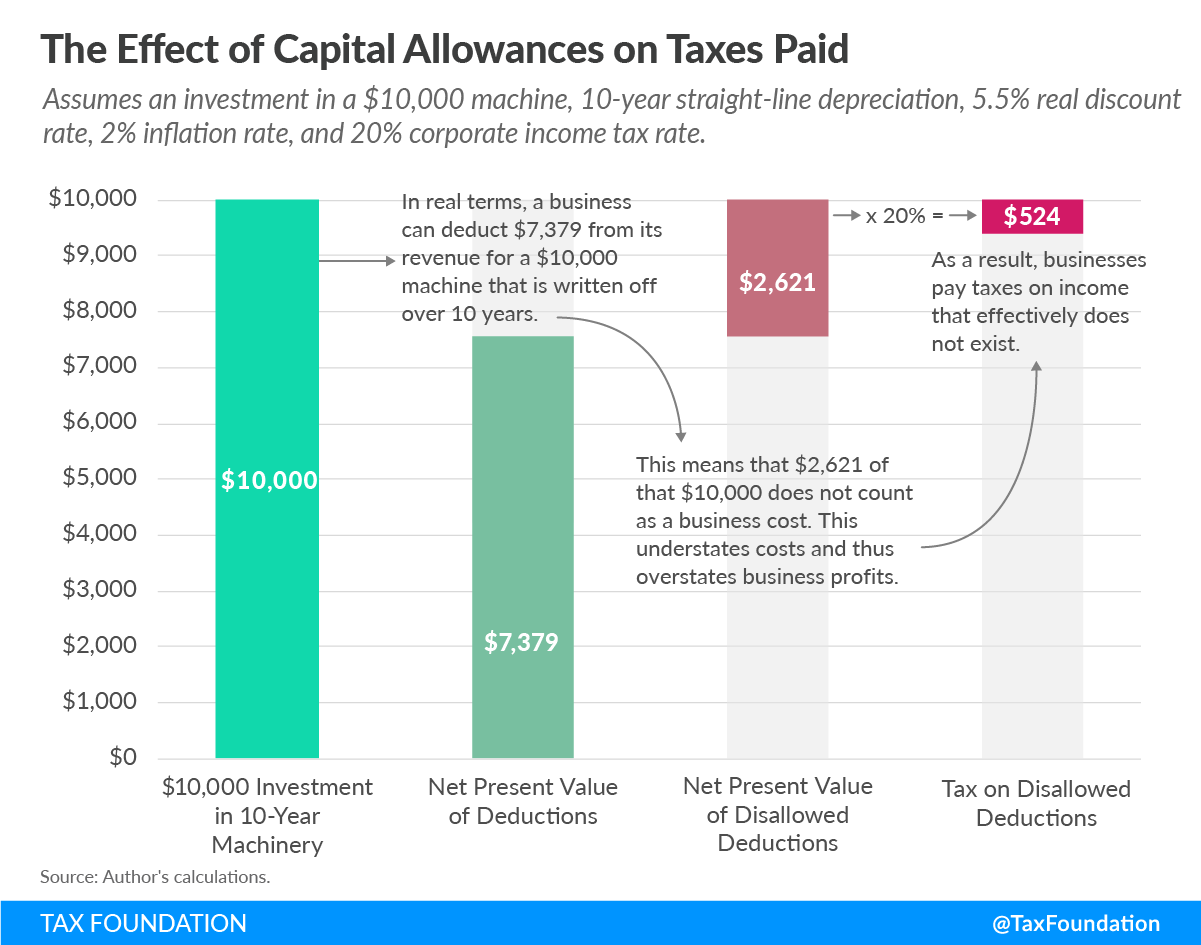

Capital Cost Recovery across the OECD Upstate Tax Professionals

distributions to you. ROC represents a return of all or a portion of your original invested capital and thus is generally not immediately taxable to you. This article describes the types of investment vehicles which may make ROC distributions and also explains the tax implications of receiving ROC distributions. Return of capital

Tax Treatment for C Corporations and S Corporations Under the Tax Cuts and Jobs Act Smith and

A return of capital distribution is a characterization of an entity's dividend payments to shareholders for income tax purposes. It is a distribution in excess of an entity's current and accumulated earnings and profits. Different from dividend income and capital gains distributions, return of capital distributions are currently non-taxable.

Starlight Capital Tax Treatment of Distributions

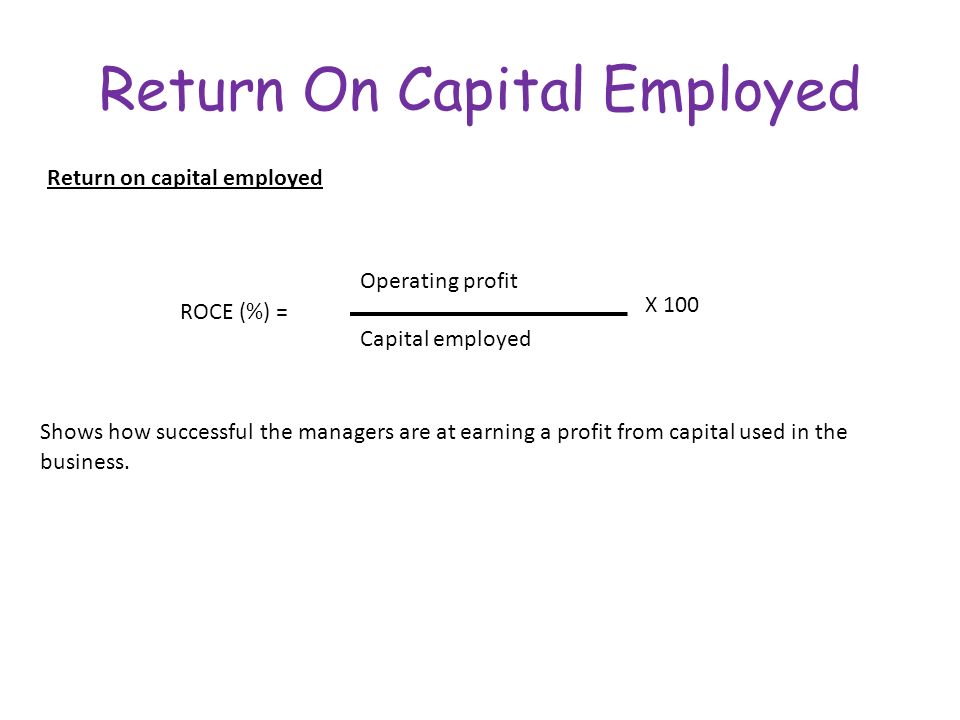

Return on equity (ROE) is a measure of profitability in relation to shareholders' equity (ie. all ownerships' interests). ROC measures profitability based on capital invested, including debt. To put it another way, the return on equity measures the company profit based on the combined total of all of a company's ownership interests.

Treatment of Tax on Shares Capital Gains or Business Onlineideation

This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders. Long-term capital gains are taxed at lower rates than ordinary.

Unequal Tax Treatment Contributing to Rising Debt Levels Entrepreneurs

A return of capital payment is not taxable, but rather used to reduce the shareholder's tax basis in ONEOK shares. Once the tax basis is exhausted, the return of capital portion of the dividend is treated as a capital gain. Generally, state law conforms to Federal law regarding the treatment of return of capital.

How to Calculate Return on Capital 8 Steps (with Pictures)

Note: This is an update to a news release originally issued Jan. 13, 2023. This corrects qualified dividend information in the table below. CMS Energy has announced the calculation of the tax status of its 2022 common stock dividends. The following is an allocation of the 2022 common stock (CUSIP #125896100) dividends for United States federal income tax purposes: Record Date Paid Date.

Return on Capital Employed Its Definition and Formula

1 Best answer. TonyC11. Level 6. RoC is reported from box 42 of T3 slips from Trusts, which includes Mutual Funds and ETFs. Enter amounts into your T3 Income entry fields, box 42. Return of Capital amounts do not affect your current taxable income or deductions, but you must take note of them and perform an Adjusted Cost Base for each investment.

- How Many Days Till September 24th

- Excel Break Links Wont Break

- Xr Abdomen Supine And Erect

- French Bulldog X British Bulldog

- National Parks Near Broken Hill

- Rg Casey Building John Mcewen Crescent Barton Act

- Paradise Island Resort Maldives Reviews

- Exposure Sports Illustrated Swimsuit 2011 Film

- Dog Food For German Shepherd Puppy

- Trung Quốc Có Mấy Múi Giờ