Superannuation in Australia a timeline APRA

What year did compulsory super start in Australia? The superannuation industry had big changes in 1992. That's when compulsory super, also called the superannuation guarantee (SG), started in Australia. The government, led by Prime Minister Paul Keating, made a law for employers to pay 3-4% of their workers' wages into a super fund.

Our Comprehensive Superannuation Guide My Wealth Solutions

In 2022, we celebrate our proud heritage, who we are today, and who we want to become over the next 100 years. It all started with one scheme—the 1922 Scheme, serving federal public servants—and, after several name changes and restructures, became the Commonwealth Superannuation Corporation in 2011. We are still loyally serving Australians.

Superannuation facing grim financial year as markets flatten AdviserVoice

The Australian Financial Review splash announcing the start of industry superannuation.. productivity growth now will finance a 3 per cent superannuation round over two years from the beginning.

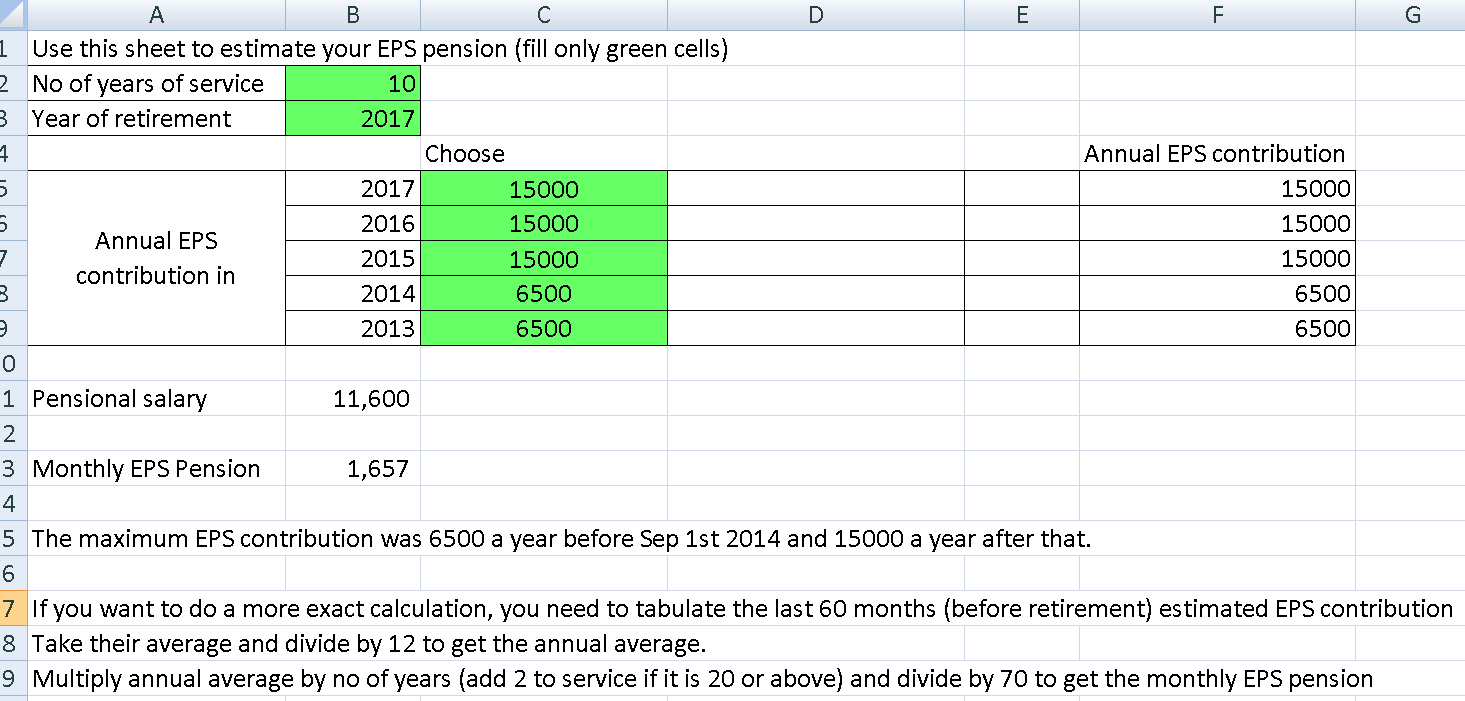

What is Superannuation Fund Benefit in India and How to calculate it?

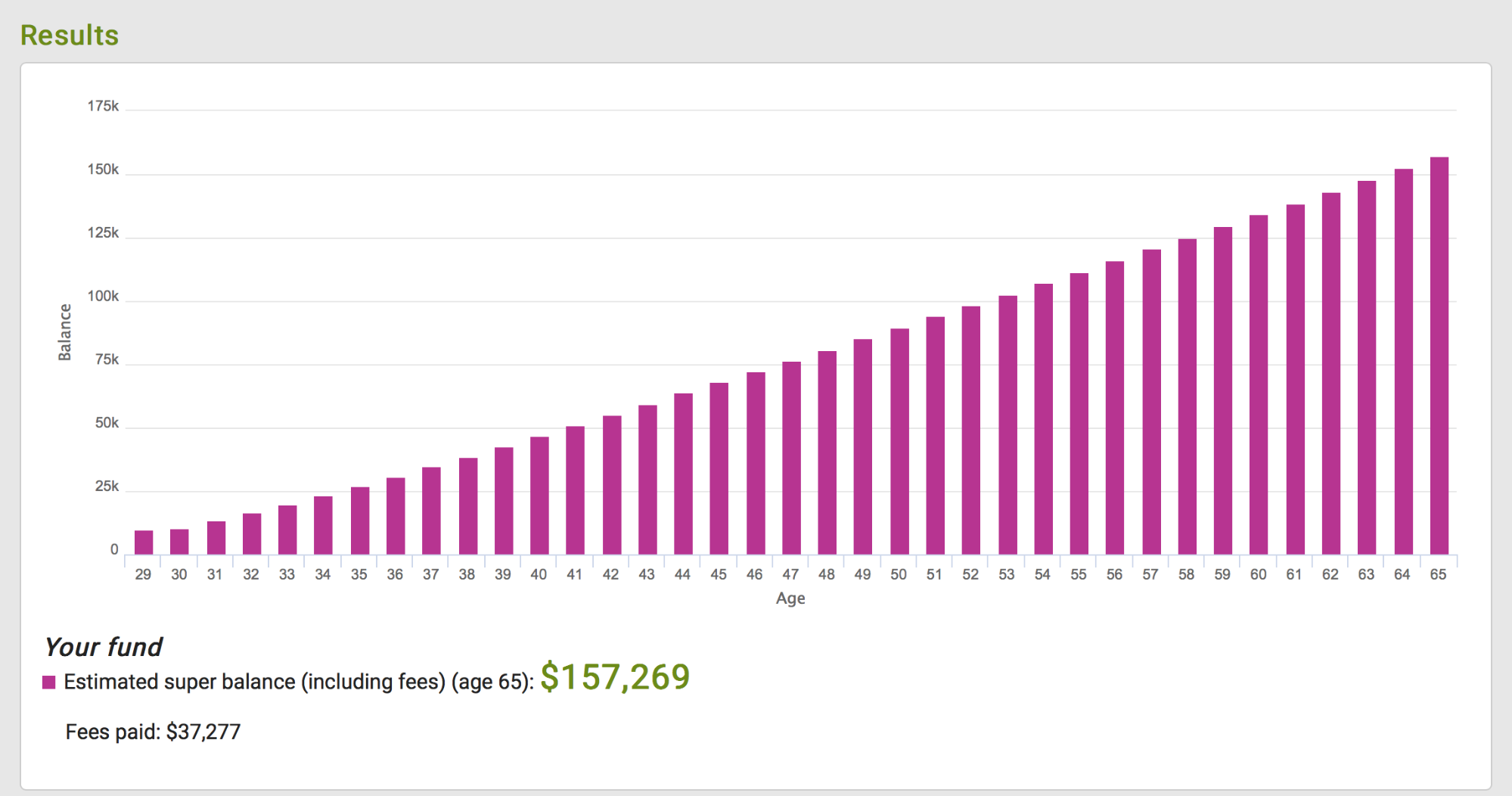

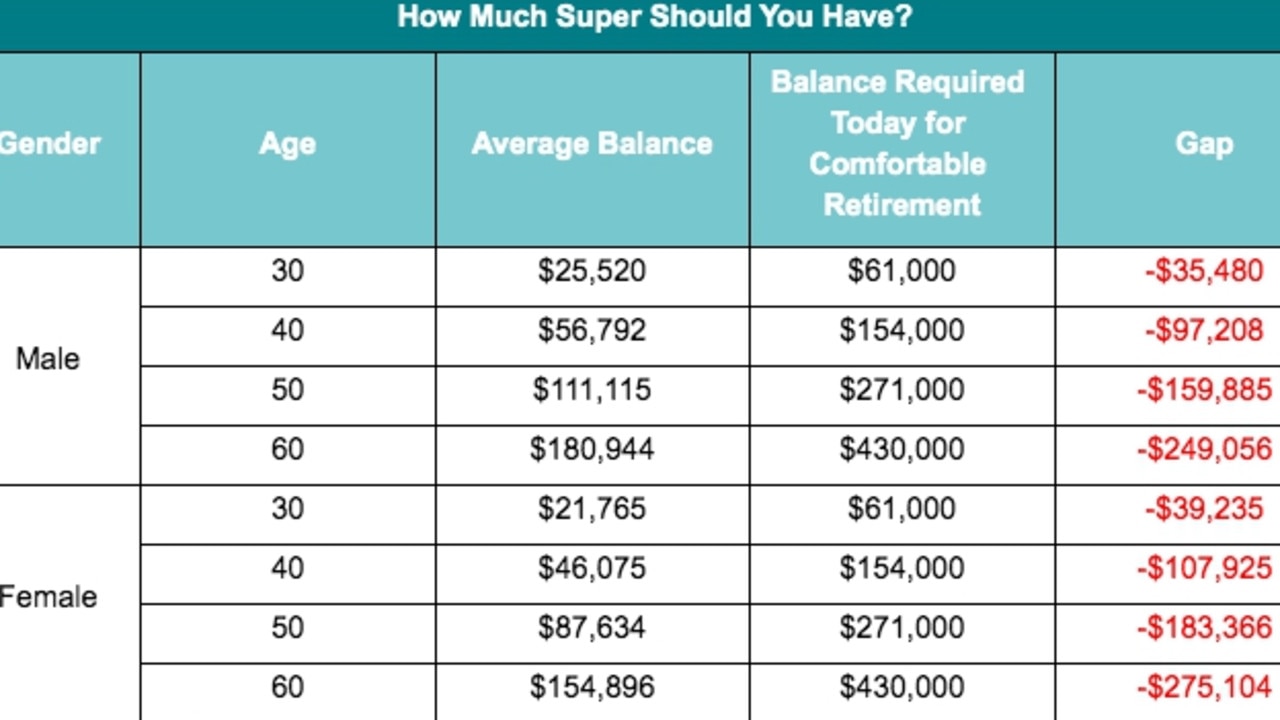

Retirees' reluctance to spend their nest egg. As at 30 June 2021, the average superannuation account balance was $106,162 overall, $93,809 for women and $117,429 for men. These balances will become more substantial over time, potentially increasing the perceived importance of this 'nest egg' for retirees.

Superannuation Excel Spreadsheet within Revised Eps Pension Calculator Find Out Increase In Eps

The new National Superannuation scheme involved a massive rise in costs, the result of higher pension levels, the abolition of the income test previously applied to the Age Benefit, and the increased numbers who qualified. Between 1975 and 1977 alone, the number of people receiving a public pension rose 28 percent.

Our Comprehensive Superannuation Guide My Wealth Solutions

The many changes superannuation has weathered over the past two decades are examined in the third part of our series on the history of superannuation in New Zealand.. although this was not to start until early in the 21st century. A new "Single Living Alone" pension rate was announced for 1990, set at 65 rather than 60 percent of the couple.

How much do you (or did you) have in your super at around 30 years old? r/AusFinance

The basics. Superannuation is a way to save for retirement at concessional tax rates. Employers have to pay 9.5 per cent of an employee's salary into super. Pre-tax contributions (up to certain.

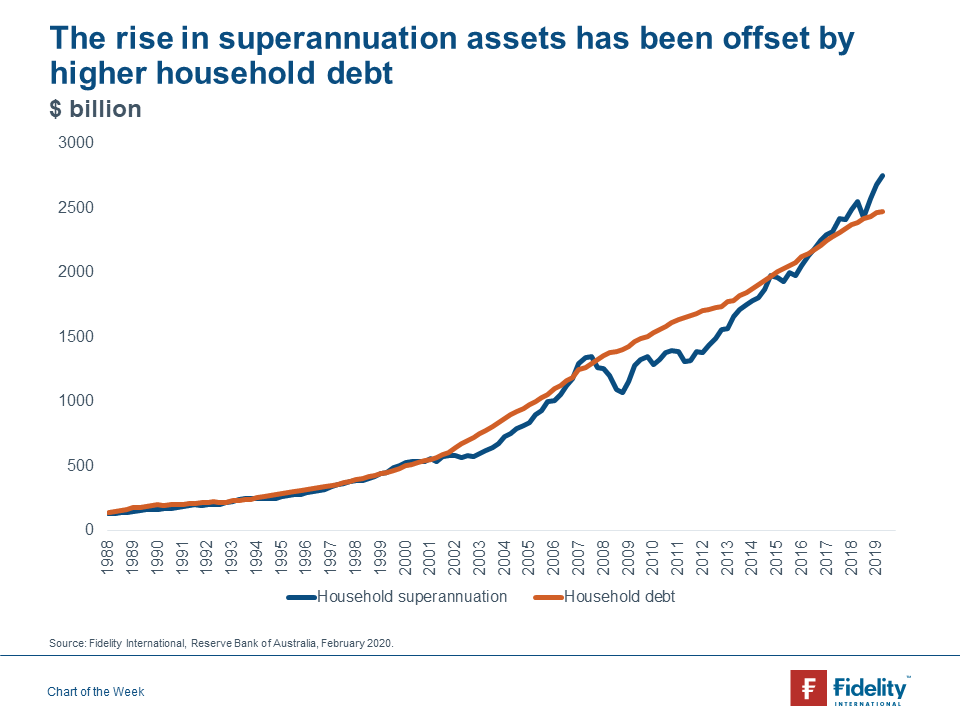

Chart of the week Superannuation Investment Insights Fidelity Australia

At the start of the 1980s, superannuation wasn't widely available in Australia. If you did have an account, it generally couldn't be transferred if you changed employers. In 1986, compulsory super was introduced under the Commonwealth Occupational Superannuation Standards Act (OSS Act) for those employed under an award to help the wider.

5 ways to boost your superannuation Praescius Financial

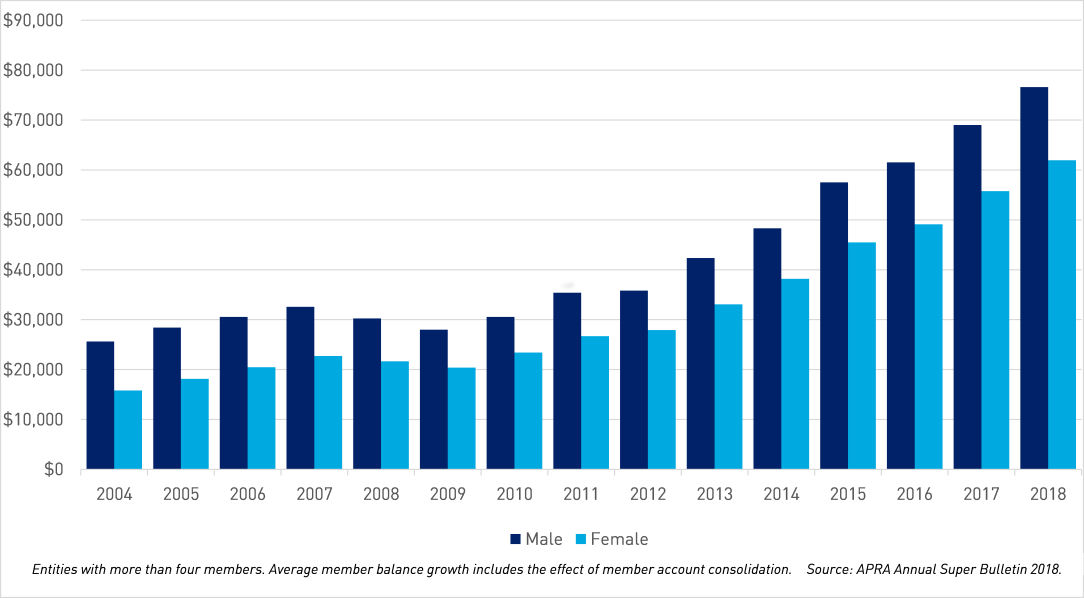

Superannuation at the start of this decade is far from widespread and isn't transferable between different employers. As a result, until the mid-1980's superannuation was generally limited to public servants and white collar employees of large corporations.. The chart below indicates that average female account balances have grown over the.

How much superannuation you should have based on your age — Australia’s leading

Here's a history of Australian superannuation. Australia's first pension plans were established in 1857 by the Australian Mutual Provident Society (now known as AMP) and in 1885 they set up one of the first staff pension funds in the world. Since then the super savings pool has grown to almost $3 trillion, being one and a half times the size of.

Superannuation strategies for 2017

Figure 1 shows that, on average, superannuation balances for women aged over 15 years were 33.5 per cent lower than men in 2015-16. This compares with a gap of 42.0 per cent in 2005-06. Superannuation gaps vary between age cohorts, with gaps lower for younger age groups and much higher for those close to retirement age.

Superannuation… it’s not a case of “set and Paradigm Strategic Planning

Here's a history of Australian superannuation. Australia's first pension plans were established in 1857 by the Australian Mutual Provident Society (now known as AMP) and in 1885 they set up one of the first staff pension funds in the world. Since then the super savings pool has grown to almost $3 trillion, being one and a half times the size of.

Specifying and reporting on progress over time — Office of the

But the industry has grown in prominence from humble beginnings. The modern super concept was born out of an employer-driven incentives regime, which developed over the early half of the 20th century. Up until the mid-1980s, super benefits were only extended to public service employees and limited white-collar professionals employed by large.

A Super start to the new financial year Superannuation Advice Australia

The start of the modern superannuation system. When the 1991 Budget was released, it introduced the Superannuation Guarantee (SG), a compulsory system of superannuation support for Australian employees. A scheme to be paid for by employers, the first year of this new Act boosted super coverage for Australians to 80 per cent.

Chronological age calc malllimo

change in the way superannuation operated for the first 130 years. Interestingly, the Income Tax Assessment Act (ITAA) 1915 provided for òexcluded ó superannuation funds with 5 members or less. This may well have been the forerunner of Self-Managed Superannuation Funds (SMSFs) as this structure opened the door for the self-

Superannuation in Australia a timeline APRA

Year. Comments on superannuation coverage. Source Documents. May 1968. Australian Bureau of Statistics conducted a survey for Victoria only of superannuation coverage.. 35.1 per cent of employed wage and salary earners were covered by superannuation.. Coverage for male wage and salary earners by industry ranged from 80.8 per cent in the public authority activities (not elsewhere included.