Permanent Account Number PAN Card Details Checking Online

A permanent account number ( PAN) is a ten-character alphanumeric identifier Foundational ID, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any person who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file known as e-PAN.

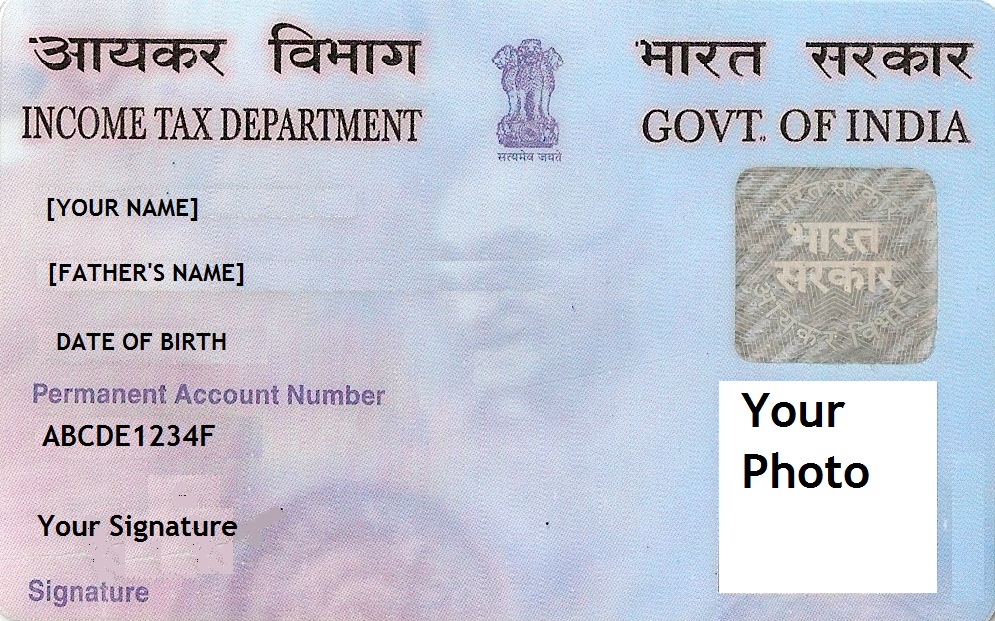

Permanent Account Number Pan Card Sample Photo

By Syskool. April 4, 2020. 1033. Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department, to any "person" who applies for it or to whom the department allots the number without an application. Permanent Account Number enables the department to link all.

PAN Card Applying for Permanent Account Number ? May not have to do this anymore HitBrother

What is PAN? Income Tax Department (ITD) issues Permanent Account Number or PAN card an alphanumeric ID in a form of card to any "person" who applies for it or to whom the department allows the number without an application. PAN enables the department to link all transactions of the "person" with the department. These transactions include tax payments, TDS/TCS credits, returns of.

Permanent account number

A permanent account number (PAN) is a ten-character alphanumeric identifier Foundational ID, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any person who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file known as e-PAN from the website of the Indian Income Tax Department.

Indian Defaulter Permanent Account Number PAN Card

PAN or Permanent Account Number is a 10-digit unique identification alphanumeric number. It is allotted to taxpayers of India. The individuals are identified via a computer-based system, where the PAN number provides all the tax-related information against a specific individual. The Income Tax Department allows the number to every individual.

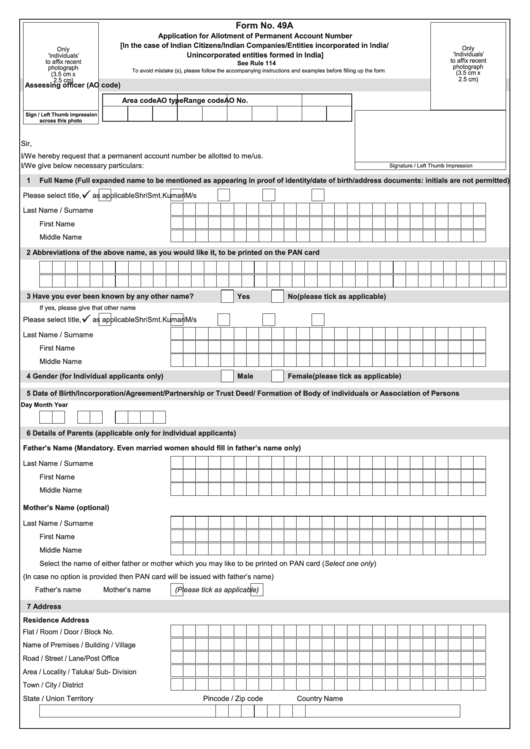

Form 49a Application For Allotment Of Permanent Account Number printable pdf download

Permanent Account Number abbreviated as PAN is a unique 10-digit alphanumeric number issued by the Income Tax Department to Indian taxpayers. The department records all tax-related transactions and information of an individual against his unique permanent account number. This allows the taxman to link all tax-related activities with the department.

Permanent Account Number YouTube

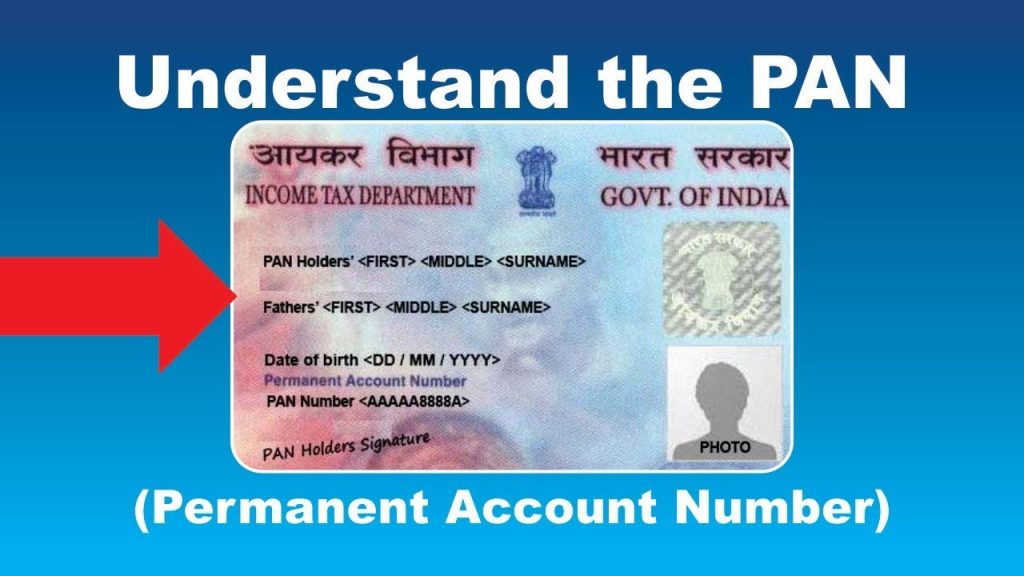

Permanent Account Number: Structure. The initial three characters - alphabetical series that runs from AAA to ZZZ. The fourth character - It represents a PAN holder's status. For example, "P" stands for a person, while "F" stands for a firm. The fifth character - The first letter of the PAN holder's surname. The following four.

Permanent Account Number (PAN)

What is Permanent Account Number (PAN)? PAN is a government-issued identity card with a unique 10-digit alphanumeric code that serves many purposes. PAN is the short form of "Permanent Account Number". The Department of Income Tax issues the Permanent Account Number (PAN) card, which has ten alphabetic and numeric digits.

_Card_20.gif)

Nagaland Online Apply Permanent Account Number (PAN) Card

Permanent Account Number in India is currently the most important economic document. After the instructions issued by the Reserve Bank of India, it has become an essential document to ease any kind of financial transaction.While the country's economic exchanges are monitored accurately by the government through PAN, citizens have convenience in many financial activities by having a Permanent.

How To Apply For Permanent Account Number (PAN)? YouTube

Tracking Permanent Account Number Status via SMS. To track your PAN status via SMS, send the following text to the number 57575. NSDLPAN<< 15-digit acknowledgement number>>. Once the server receives this text, you will get a reply via SMS indicating the current status of your Permanent Account Number (PAN Card).

How To Register Your Small Business In India Blog BulbandKey

2981 Views. A Permanent Account Number (PAN) is a unique 10-character alphanumeric code issued by the tax authorities. It's used to identify individuals and entities for taxation and financial transactions. PAN helps track financial activities like income, taxes, and investments.

Permanent Account Number (PAN) All you must know Housing News

The Permanent account number Or a PAN is one of the most important documents for Indians. From jobs to banks, post offices to education, the PAN card is useful in all places. PAN Card. Hidden Digits. A PAN card is a unique 10-digit alphanumeric number issued by the Income Tax Department. It's issued in the form of a laminated plastic card and.

All about the Permanent Account Number (PAN) CA Rajput

Permanent Account Number (PAN) is a critical component of the Indian taxation system, serving various purposes. In this comprehensive article, we delve into the world of PAN, exploring its significance and functionality.

The need to link PAN to Bank Accounts Law Times Journal

1. What is PAN (Permanent Account Number) The provisions of Section 139A of the Income Tax Act, to be read with Rule 114 of the Income Tax Rules deal with the requirement of application and obtaining of Permanent Account Number. Quoting of the Permanent Account Number (PAN) has been made mandatory by the I.T. Department in many instances.

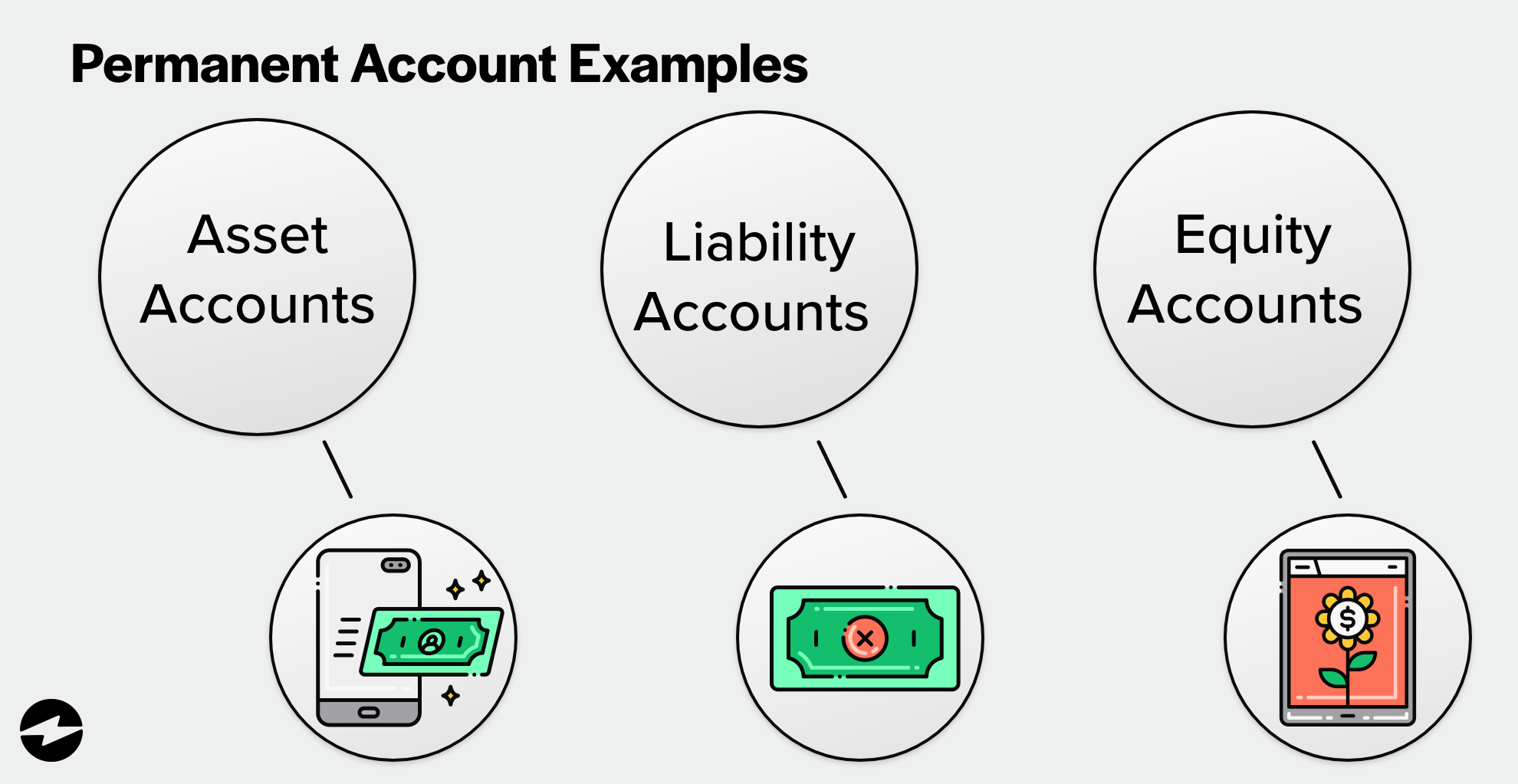

Permanent vs Temporary Accounts What’s the Difference?

PAN (Permanent Account Number) is a unique identification assigned to all taxpayers in India. It is an electronic system to record tax-related information and is essential for various financial transactions. PAN card contains personal details, and its structure is detailed. Costs, eligibility, and documents needed for PAN are outlined.

Permanent account number

Permanent Account Number or PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. Out of the first five characters, the first three characters represent the alphabetic series running from AAA to ZZZ. The fourth character of PAN represents the status of the PAN holder. "P" stands for Individual "C" stands for.

- Anne Mccaffrey Dragonriders Of Pern

- Barron Gorge National Park Cairns

- Bob Jane T Marts Macgregor

- Costco Is Closing Down A Popular Store In Melbourne

- Jujutsu Kaisen Dubbed Season 2

- Maximum Class Size Nsw Primary School

- Sheikh Zayed Road Dubai Hotels

- Chainsaw Man Manga Box Set

- Ford Flathead Motors For Sale

- Blessed Sacrament Catholic Church Hollywood