Difference between Authorised Capital vs Paid Up Capital

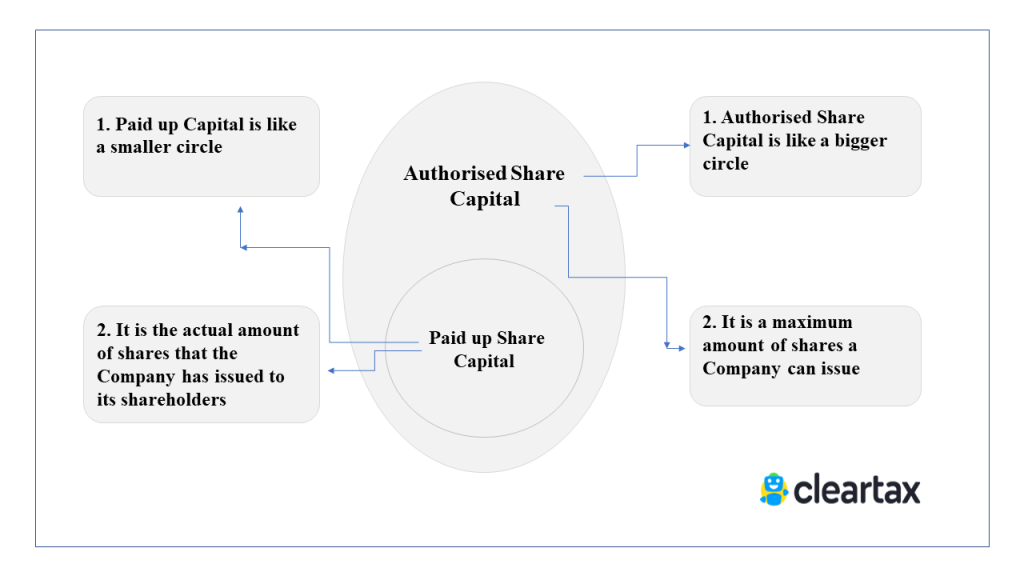

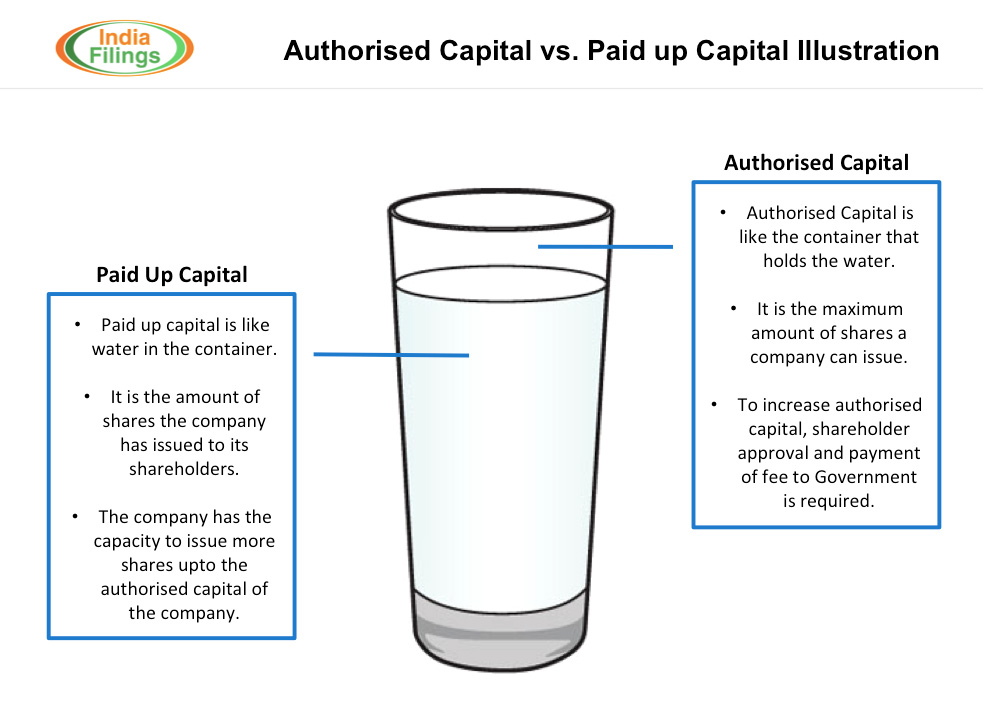

Paid-up Share Capital. It is the amount of money for which shares of the Company were issued to the shareholders and payment was made by the shareholders. At any point of time, paid-up capital will be less than or equal to authorised share capital and the Company cannot issue shares beyond the authorised share capital of the Company.

Difference between Authorised Capital and Paid up Share Capital

What is Paid-Up Capital? Paid-up capital refers to the amount that has been paid-up on shares that have been issued by a company. These shares may be ordinary shares, preference shares or some other class of shares. How is paid-up capital different from share capital? Issued share capital is the total amount of consideration (i.e. money and other assets) that shareholders have contributed to.

What Is Paidup Capital In Singapore Companies SG Company Services

Paid-up capital is a fundamental concept in finance and corporate management, indicating the extent to which a company is financed through equity. It serves as a foundation for growth and financial health, allowing businesses to undertake various activities without the need to incur debt. As such, both companies and investors pay close.

Meaning of share capital, Paid up capital, Authorised capital, issued capital YouTube

Paid-up capital is a key indicator of a company's reliance on equity financing and financial stability. Authorized capital represents the maximum amount a company can raise through stock sales. Show Article Sources. Paid-up capital, also known as paid-in capital, plays a crucial role in a company's financial structure. This article explores the.

Authorised Capital And Paid Up Capital

The difference between called-up share capital and paid-up share capital is that investors have already paid in full for paid-up capital. The amount of share capital shareholders owe, but have not paid, is referred to as called-up capital. Any amount of money that has already been paid by investors in exchange for shares of stock is paid-up.

What is Authorized Capital, Issued Capital and PaidUp Capital? Explained! YouTube

Paid Up Capital (PUC) is a critical concept in taxation, and it plays a pivotal role in determining the amount of capital that can be distributed to shareholders as a tax-free return of capital. PUC is primarily determined based on the legal stated capital of shares issued by a corporation under the relevant corporate laws. This legal stated.

Paid in Capital How to Calculate a Paid In Capital BalanceSheet?

Paid-up Capital. Paid-up capital is the amount of money received by the company when it sells its shares to the shareholders and investors directly through the primary market. In other words, it is the money that the investors give to the company on buying a share in that company. If these shares are bought or sold in the secondary market, the money does not go to the company but it goes to.

share capital, authorised capital, issued capital subscribed capital, called up capital, paid up

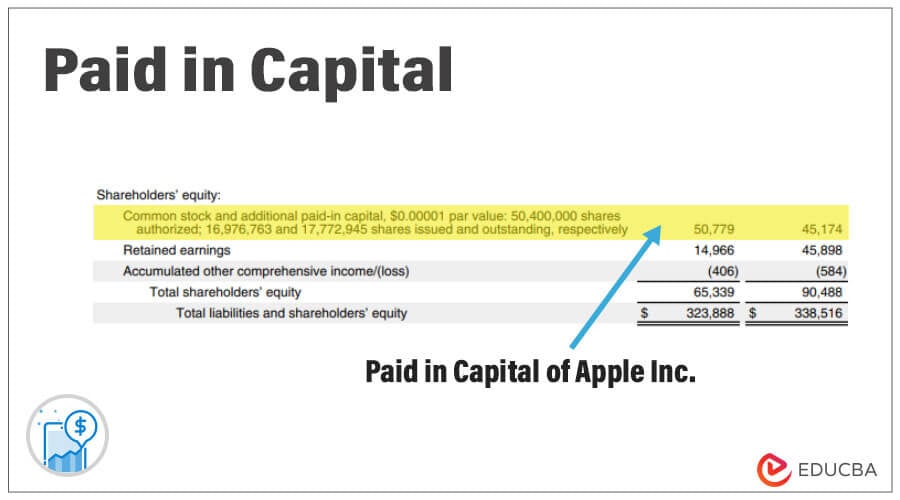

Paid-Up Share Capital is the amount invested by shareholders. It's the company's common stock or equity. A corporation raised $10 million from stockholders and issued 1 million $1 shares. $10 million divided by 1 million shares is paid-up capital (or 10 cents per share). The balance statement also lists the company's indebtedness.

What is Paid Up Share Capital? Features & Significance

Paid-up capital: Authorised capital: Meaning: It represents the capital infusion made by shareholders when they acquire company shares. It constitutes the segment of authorised capital that has been fully paid for. It signifies the highest capital limit that a company is legally permitted to generate by issuing shares. It is the upper limit.

Authorized Capital and Paidup Capital Finaxis

How Does Paid-Up Capital Work? Let's assume Company XYZ decides it needs to raise $10 million in equity in order to build a new factory. It does this by issuing 100,000 shares of new stock at $100 per share.. The company records the receipt of $10 million of cash on the asset side of its balance sheet after the offering is complete. It also records the corresponding equity on the balance sheet.

A Guide to PaidUp Capital in Singapore

Authorized Capital sets the maximum limit of capital that a company can issue, while Paid-Up Capital represents the actual funds that shareholders have invested in the company. While Authorized Capital provides a framework for the company's financial activities and capacity to raise funds, Paid-Up Capital reflects the level of financial support.

What is PaidUp Capital? Understand share capital for companies.

Paid-up capital doesn't need to be repaid, which is a major benefit of funding business operations in this manner. Also called paid-in capital, equity capital, or contributed capital, paid-up capital is simply the total amount of money shareholders have paid for shares at the initial issuance. It does not include any amount that investors later.

Authorised Capital VS Paid up Capital with Illustration

Paid-up capital is the amount of money a company has received from shareholders in exchange for shares of stock. Paid-up capital is created when a company sells its shares on the primary market.

Comparison Between Authorised Capital and Paid up Capital Provenience

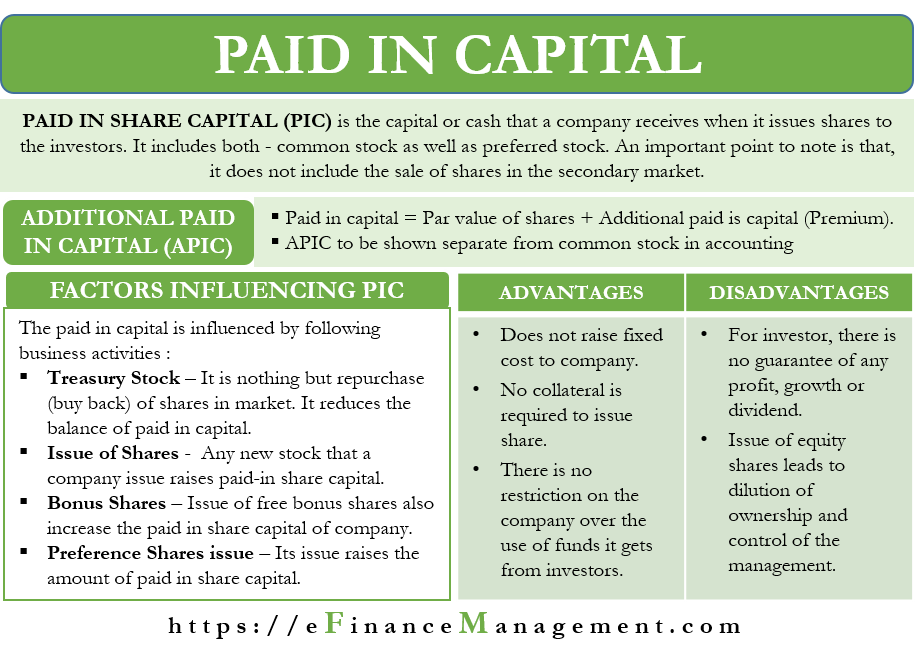

Paid-in capital also known as contributed capital, describes the amount of money invested into a company by investors for which the investors received shares of the company's stock. This is the.

Paidin Capital Meaning, Advantages Disadvantages and More

Paid-Up-Capital or PUC is a concept under the federal Income Tax Act (ITA). PUC is the precise amount a shareholder pays for his or her shares. Generally speaking, PUC can be returned to shareholders free of tax (including Part XIII withholding tax), whereas other distributions of capital are taxable as either a dividend or a taxable.

Guide to paidup capital in Singapore

Paid-up capital meaning is the sum of money that a company gets from shareholders in exchange for ownership of shares. It serves as a critical indicator of a company's financial strength, stability, and value.

- Drawings Of A Full Moon

- New Zealand Spark Sim Card

- She Was Lyrics Talking Heads

- Treat Them Mean Keep Them Keen Meaning

- Ball Bearing And Roller Bearing

- Veronica Falcón Movies And Tv Shows

- Is Highpoint Open On Australia Day

- East Coast New Zealand North Island

- Til Death Do Us Part 2017 Movie

- Closest Airport To Fraser Island