What is Going Concern Concept in Accounting

Therefore, the going concern concept provides a way to record the value of such assets. 2. It is the basis on which the profits and losses of the business are recorded for the year to which it belongs. Disadvantages of Going Concern Concept. Listed below are some of the disadvantages of the going concern concept: 1. Financial statements are.

Going Concern Concept Guide to Going Concern Concept with Examples

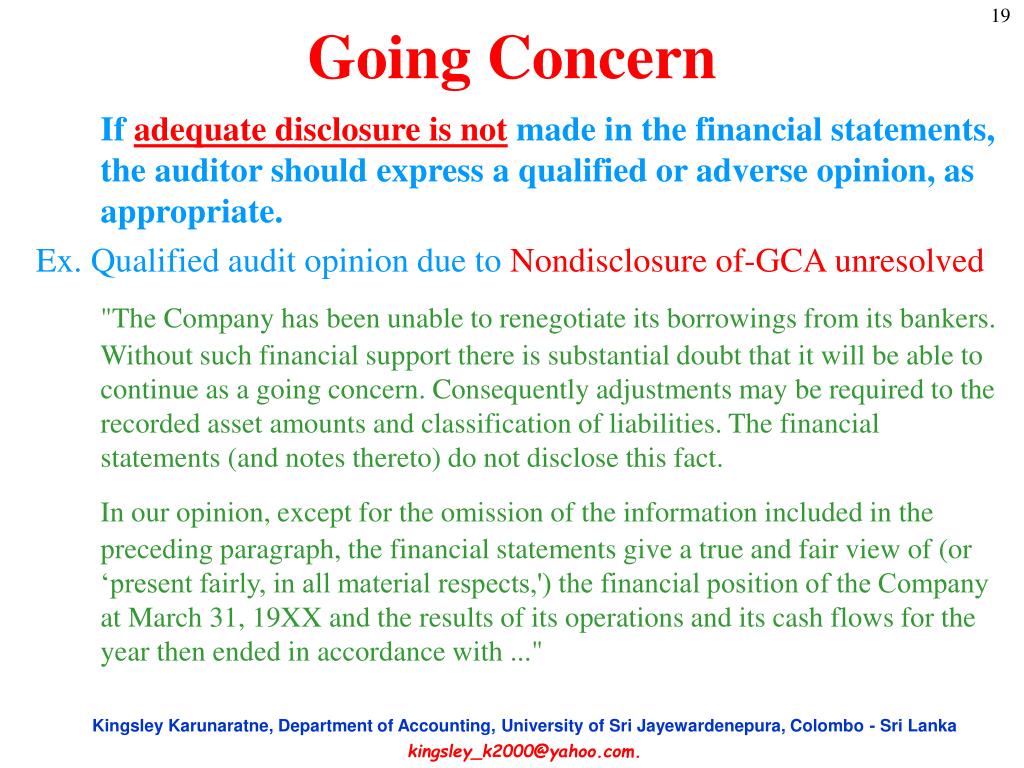

The going concern standard requires management to make a reasonable effort to identify these conditions and events. Management will need to determine whether it can do this assessment using its current processes and controls or whether it needs to modify its processes and controls or implement new ones.

Going concern accounting policy in auditing

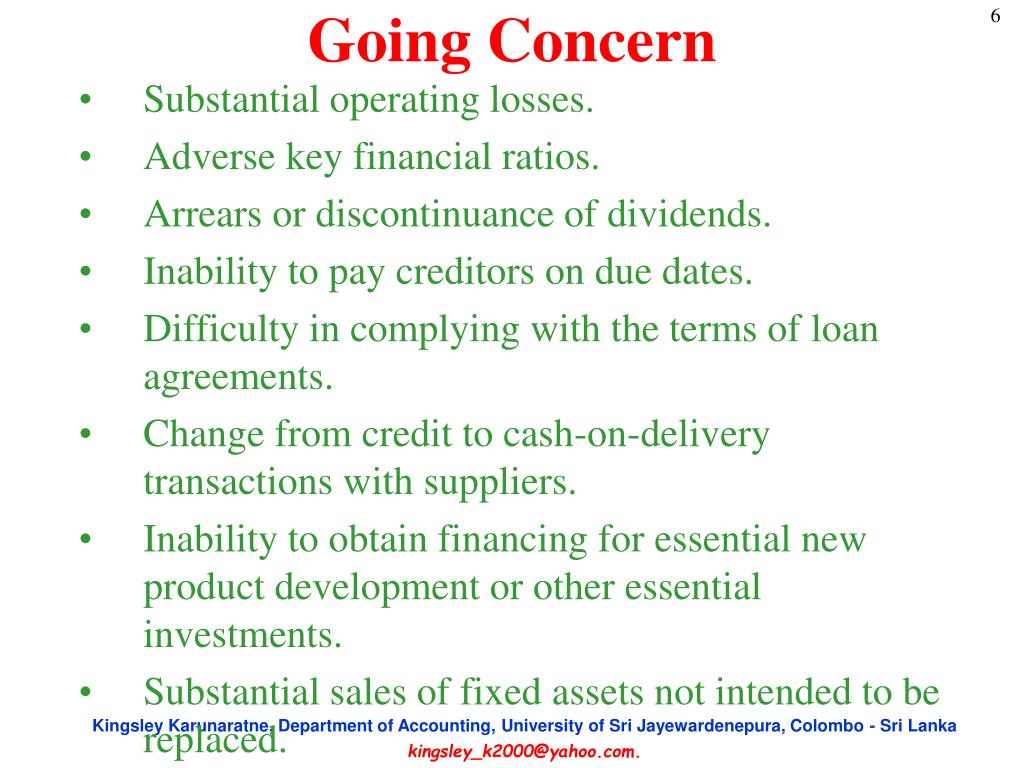

24.5.1 Assessing going concern. Financial reporting under US GAAP assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent. This is commonly referred to as the going concern basis of accounting. If a reporting entity faces conditions that give rise to uncertainties about its ability to.

PPT Going Concern SLAuS 21 PowerPoint Presentation, free download ID3027644

Going concern is a determination that a company has sufficient assets and revenue to continue operating for the foreseeable future. Businesses that are expected to remain afloat are referred to as.

Going Concern Stock Vector Image by ©zagandesign 29045535

The going concern principle is the assumption that an entity will remain in business for the foreseeable future. Conversely, this means the entity will not be forced to halt operations and liquidate its assets in the near term at what may be very low fire-sale prices. By making this assumption, the accountant is justified in deferring the.

PPT GOING CONCERN PowerPoint Presentation, free download ID670776

There are three situations that ISA 570 identifies in terms of the use of the going concern basis of accounting: use of the going concern assumption is appropriate but a material uncertainty exists. use of the going concern assumption is inappropriate. management unwilling to make or extend its assessment. Use of the going concern assumption is.

Going Concern Accounting and Auditing CPA Hall Talk

A going concern is an accounting term for a business that is assumed will meet its financial obligations when they become due. It functions without the threat of liquidation for the foreseeable future, which is usually regarded as at least the next 12 months or the specified accounting period (the longer of the two).The presumption of going concern for the business implies the basic.

Going concern assessment amidst COVID19 IndiaFilings

The going concern concept accounting reveals the true financial integrity of an organization. It is an action an organization conducts to ensure a clearer picture of their financial and growth related concerns. As per the going concern concept in accounting standards, financial statements reveal the business's 'true and fair value,' again.

Going Concern

The going concern presumption - i.e. that the company will be able to meet its obligations when they become due - is fundamental to financial reporting. With the timing of the economic recovery from COVID-19 yet unknown, this year many companies may need to approach their going concern assessment differently. There is typically heightened.

Going Concern YouTube

GOING CONCERN definition: if a company is sold as a going concern, it is sold when it is operating normally: . Learn more.

Things You Should Know About Going Concern Concept Accotax

The going concern assumption is a basic underlying assumption of accounting. For a company to be a going concern, it must be able to continue operating long enough to carry out its commitments, obligations, objectives, and so on. In other words, the company will not have to liquidate or be forced out of business.

PPT Going Concern SLAuS 21 PowerPoint Presentation, free download ID3027644

The going concern concept is a key assumption under generally accepted accounting principles, or GAAP. It can determine how financial statements are prepared, influence the stock price of a.

The Terminology of Going Concern Standards The CPA Journal

A going concern, also known as a going concern assumption or going concern principle, is an accounting assumption stating that a business will stay in operation for the foreseeable future. In essence, that means that there is no threat of liquidation for the foreseeable future, which is usually perceived as a period of time lasting for 12 months.

PPT GOING CONCERN PowerPoint Presentation, free download ID6845208

Going Concern in Accounting. Accounting holds many fundamental assumptions that allow accounting theory to function. One of these concepts is going concern. This concept plays a vital role in preparing financial statements of a company on the basis of whether the company is a going concern or not.

What is Going Concern Value?

The going concern principle is a fundamental accrual accounting principle that assumes a company will continue operating indefinitely for the foreseeable future. The reason the going concern assumption bears such importance in financial reporting is that it validates the use of historical cost accounting. For instance, the value of fixed assets.

PPT Going Concern SLAuS 21 PowerPoint Presentation, free download ID3027644

Going concern is an accounting term for a company that has the resources needed to continue to operate indefinitely until a company provides evidence to the contrary, and this term also refers to.