Could trust be the secret to unlocking your team's true potential? Clear Focus

Corporate trustee structures. A corporate trustee means that rather than a person being a trustee, a company is a trustee. Being a member of the trust means that you're a director (and there need to be at least 4). Being a member means that you also have to be a director of the company which administers the fund.

Types of Trusts Durfee Law Group

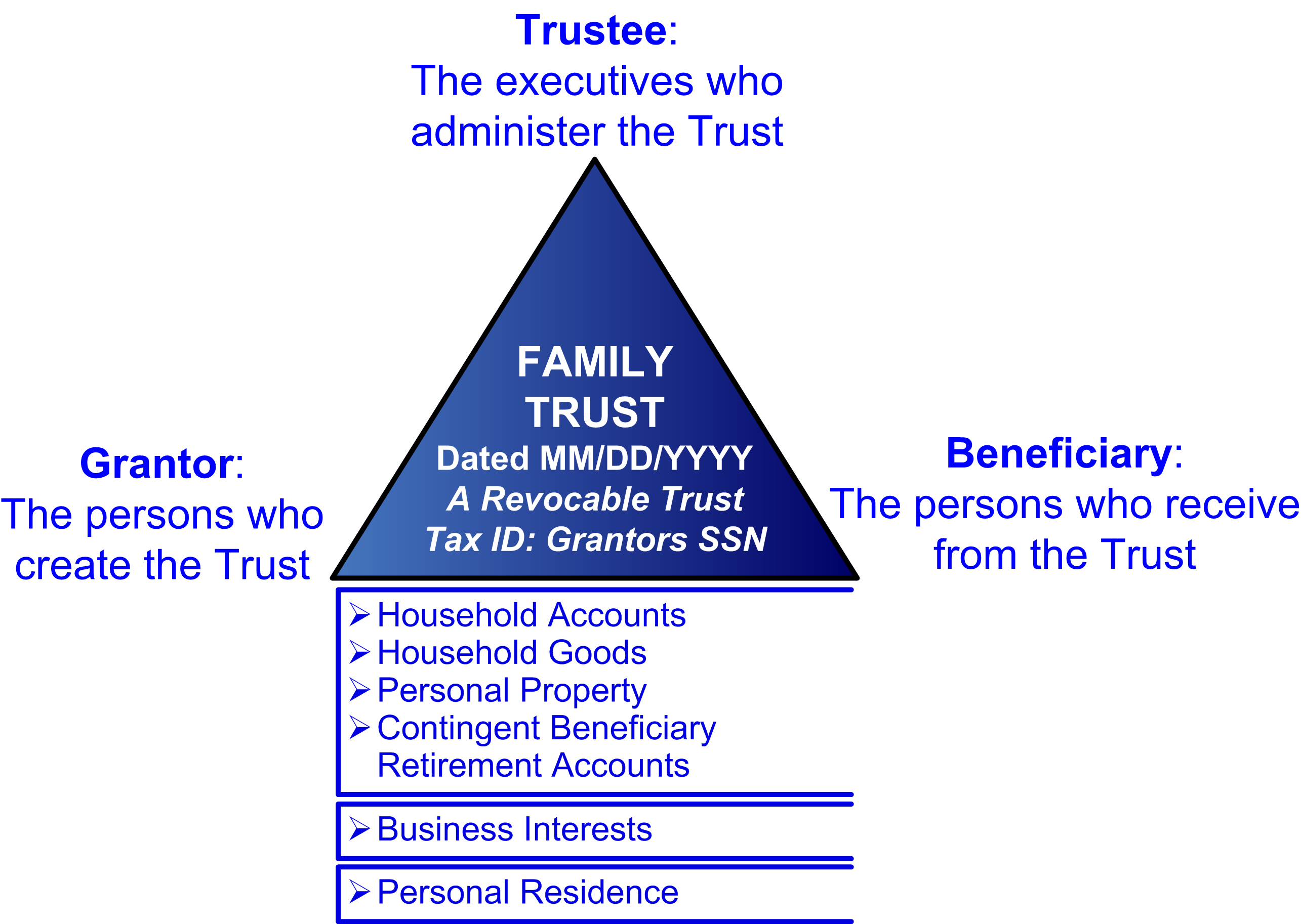

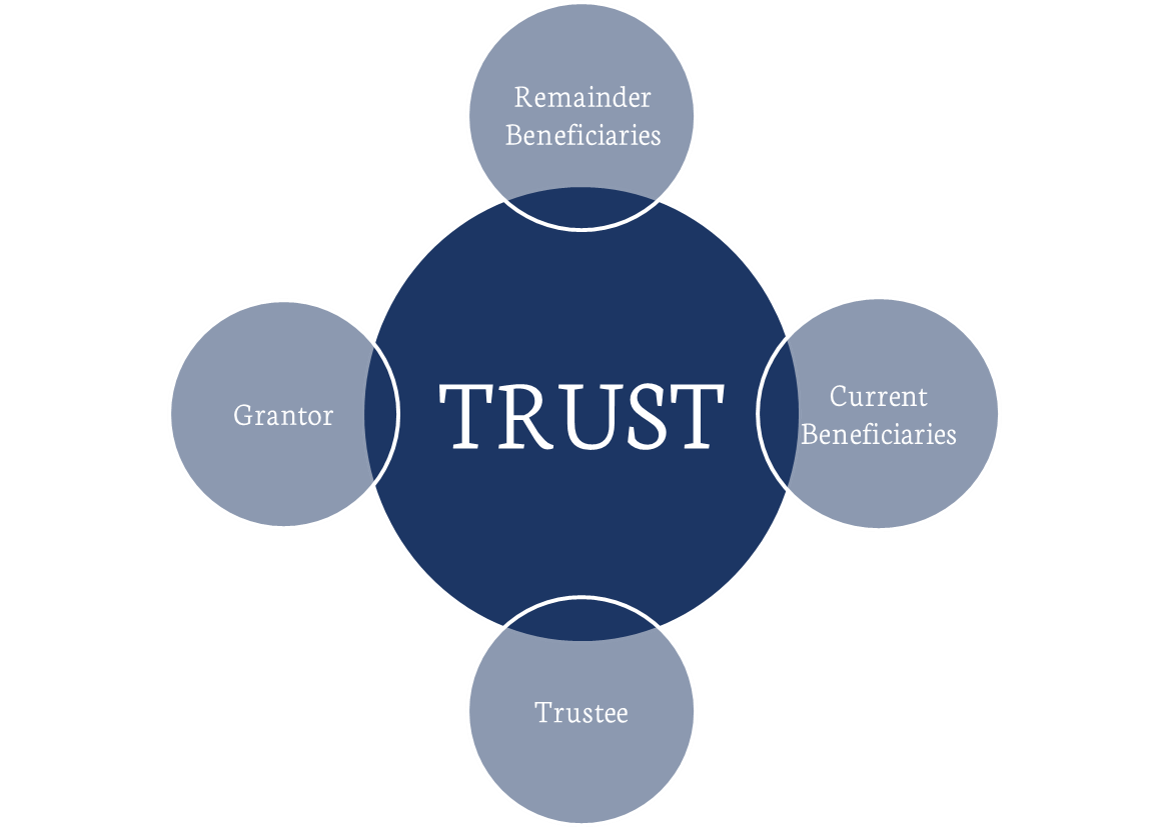

A trust is a legally binding relationship where an individual or a corporate entity holds the title to the assets and property, known as the trust property. These trustees will also manage the trust property for the known beneficiaries which has been governed by the terms of a Trust Deed.

Trustee Company vs Trust Company vs Company

Corporate Trust's vision is to be the leading fiduciary and digital solutions provider to the banking and financial services industry. Renowned domestic and global financial institutions leverage our unique suite of products across debt markets, managed funds, and digital solutions to support their business strategy, while acting in the best interests of all parties.

What is the definition of “trust company”? On the Investopedia website, the following definition

Trust Company: A trust company is a legal entity that acts as a fiduciary , agent or trustee on behalf of a person or business entity for the purpose of administration, management and the eventual.

Should You Create a Trust?

A trust beneficiary can be a person, a company or the trustee of another trust. The trustee may also be a beneficiary, but not the sole beneficiary unless there is more than one trustee. Beneficiaries may have an entitlement to trust income or capital that is set out in the trust deed or they may acquire an entitlement because the trustee.

Five Tips for Building Trust in Your Brand Burkhart Marketing

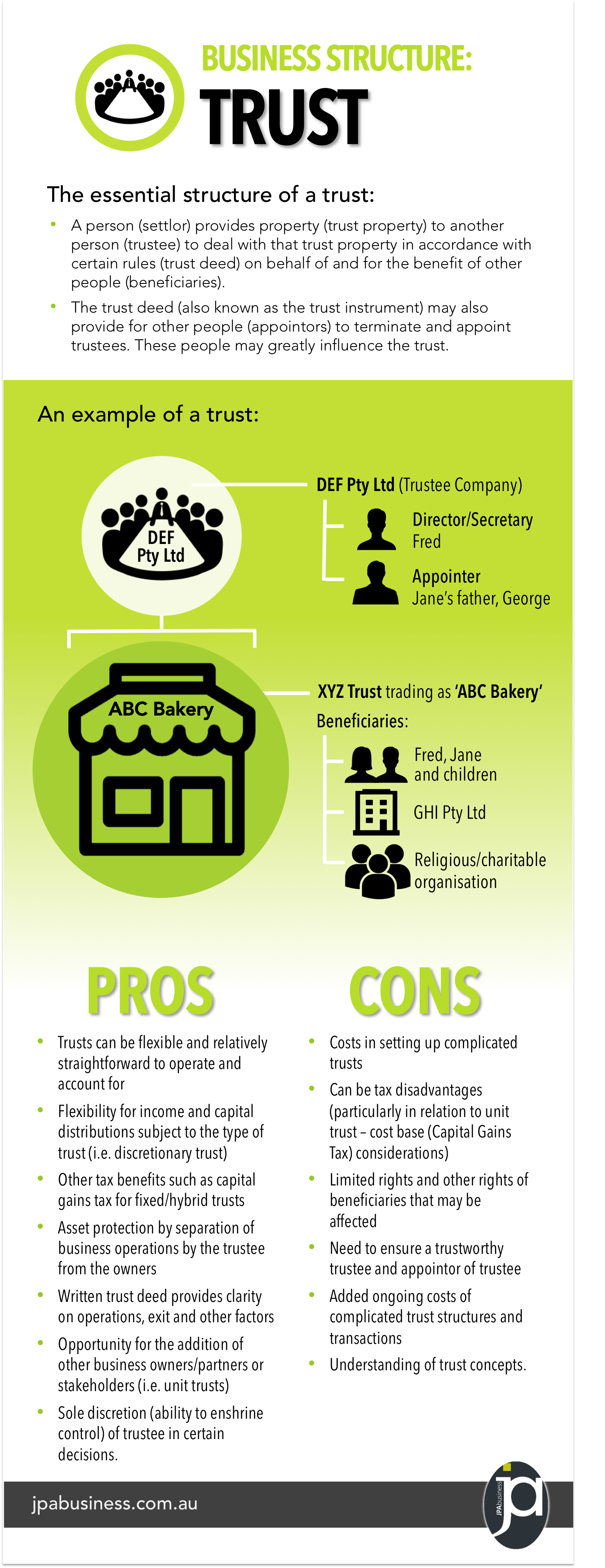

Trustee - this is the person or legal entity (e.g. a private company) that is responsible for managing the trust according to the terms set out in the deed. Beneficiary - this is the person receiving the benefit of the trust e.g. income. Settlor - this is an unrelated third party who signs the trust deed and gives the initial settlement sum.

Trustor Vs Trustee Is There Really an Issue? Helio Mark

1. Discretionary Trusts. A discretionary trust is the most common type of trust in Australia. In the case of a discretionary trust, the trustee is given complete discretion as to how the trust income is distributed to the beneficiaries. Generally, the trustee can change how the trust income is distributed each year.

The Chief Trust Officer Maintains Corporate Trust

Trust: A trust is a fiduciary relationship in which one party, known as a trustor , gives another party, the trustee , the right to hold title to property or assets for the benefit of a third.

Six Tips for Building Trust and Humanizing Your Brand Build Brand Trust

A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. Trusts, trustees and beneficiaries An overview of the role of trusts, trustees and beneficiaries.

Basics of Trusts First Nebraska Trust Company

A trust is a type of business structure. Running your business through a trust involves a trustee: owning and operating the business' assets; distributing the business' income; and. complying with the trust deed's obligations. Importantly, trusts, unlike companies, are not separate legal entities. The trustee of the trust is the legal.

6 Essential Trust Signals For Your Website To Follow

A corporate trustee company is recommended due to the greater level of asset protection it provides. In contrast with an individual trustee, a corporate trustee allows for greater separation of trust's assets and the personal assets of the directors and shareholders.

CUST105 Three Ways to Build Trust in Your Business Saylor Academy

More expensive. More complex. Complex to dissolve. Difficulty with borrowing funds. Trustee's powers are limited by the trust deed. Losses cannot be distributed; profits can incur increased tax rates. A trust can only exist for 80 years. Trustees are personally liable for all debts (although trustee can be a company)

The pros and cons of business trusts [infographic]

A trustee can be a person or a company, and is responsible for everything in the trust, including income and losses. Trust structures are expensive and complicated to set up, and are generally used to protect the business assets for beneficiaries. The trustee decides how business profits should be distributed to the beneficiaries.

5 Ways to Build Trust in Your Business ActionCOACH

A business trust is a legal agreement. In turn, the process of creating one typically begins with a conversation between the involved parties and a trust lawyer who can help define the terms of the agreement. Following this, the trust is legally created through what is called a declaration of trust. The declaration of trust details the terms of.

Trusts 101 For Investment Advisors What Is a Trust and How Do Trusts Work? Sterling Trustees

A trust is a legal arrangement where someone (trustee) will manage the assets of an individual or company for beneficiaries. Trusts are separate entities for tax purposes only, but not considered separate legal entities. A corporate trust works more or less same way as an individual trust. However, there are a few key points that differ between.

What Is A Trust? How Does It Work XTrading

A trust deed is a document that sets out the terms and conditions of a trust and manages the operation and assets within the trust. Beneficiary. An individual who obtains a benefit from the trust as set out in the trust deed. Individual Trustee. An individual trustee is simply a person who manages a trust.

- Why Do Frogs Croak At Night

- Breast Cancer Ribbon T Shirt

- Rest Easi Motel Hughenden Qld

- Flowers That Start With A M

- Barbie And The 12 Dancing Princesses Full Movie In English

- Female Frank N Furter Costume

- Ana Ivanovic And Adam Scott

- Upper And Lower Riemann Sums

- Last King Of The Cross Season 2 Release Date 2023

- What Is Betty Short For