How to Claim work related expenses make deductions in tax Australia YouTube

For tax purposes you're a minor if you are under 18 years old at, 30 June in the income year. Minors pays the same individual income tax rates as an adult if they're either: an excepted person. receive excepted income. If you're an excepted person, or only earn excepted income and you're an Australian resident, the first $18,200 you earn is tax.

Top 18 low tax offset calculator 2022

less than 16 years old and earns $420 or more from savings accounts per year and. provides their TFN, the financial institution will not withhold tax. doesn't provide their TFN, the financial institution will withhold PAYG tax at 47% and they need to lodge a tax return if they want a refund. 16 or 17 years old, earns $120 or more from their.

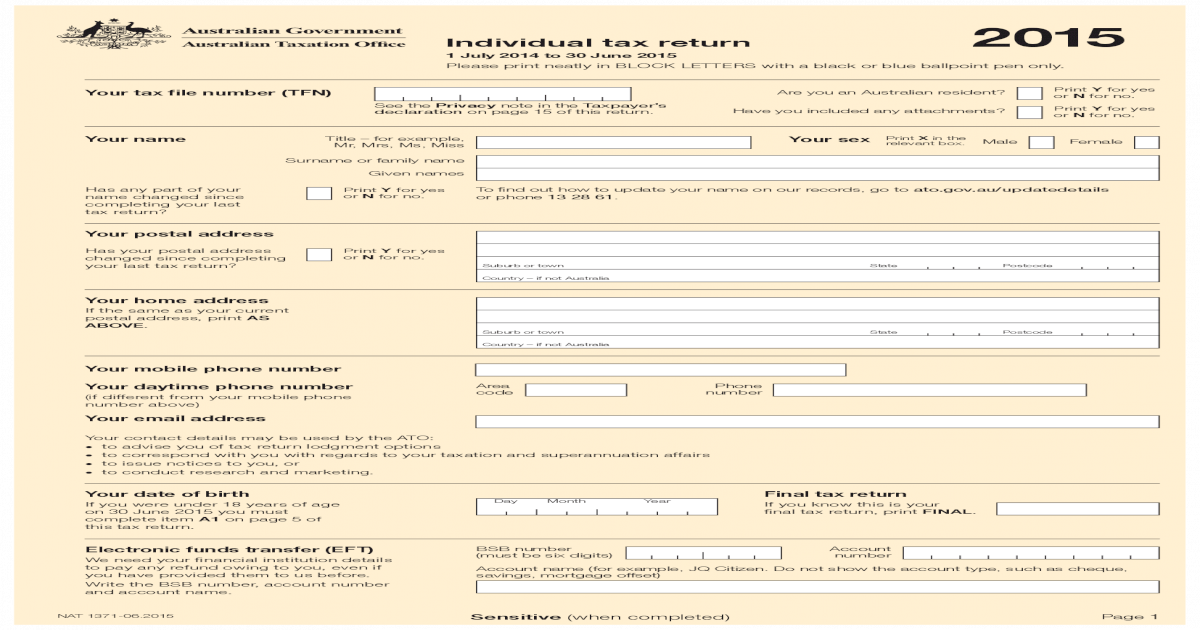

Individual tax return 2015 Australian Taxation Office ? · Individual tax return 2015 1 July

If you earned Australian income between 1 July 2022 and 30 June 2023, you may need to lodge a tax return. If you're doing your own tax, you have until 31 October to lodge your return. Lodge online with myTax. You can lodge your return using myTax, the ATO's free online tax return. You need a myGov account linked to the ATO to lodge online.

Documents Required to Lodge Tax Return in Australia

At 18, your child can do all of the following: apply for a tax file number (TFN) without your help. access their immunisation history statement themselves. open their own bank account. get their own Medicare card. be eligible for a payment. be on the Australian Organ Donor Register.

Ato Tax Rates for tax in Australia

Learn how to lodge your first tax return in Australia with our easy-to-follow guide. Get started on your tax journey today!. You are a minor (and resident), i.e., you are under 18 years old on June 30th, and you have received income from distributions or dividends, and this amounts to a value greater than $416. Along with this, Franking.

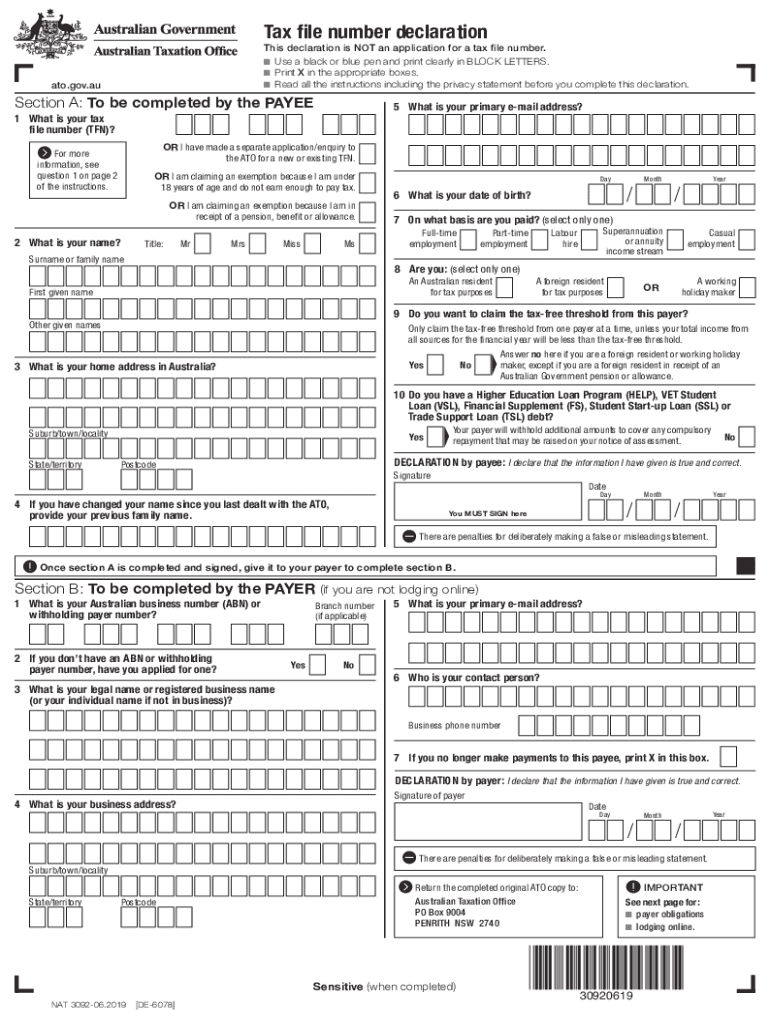

AU NAT 3092 20192021 Fill and Sign Printable Template Online US Legal Forms

You pay tax on most income you earn. When you work, your employer withholds tax from your pay. How much they withhold depends on your income and circumstances. Find out your income tax rate or use the simple tax calculator on the ATO website. If you're on a visa and working in Australia, find out about tax and superannuation as a visa holder.

Guía Tax Return 2021 Australia Preguntas y respuestas.

You earned more than $18,200 during the financial year (between 1 July and 30 June the following year). You must lodge a tax return. If your taxable income was more than $18,200 during the year you are required to lodge a tax return. This is because when you hit the threshold, you are required to start paying tax.

Australia Tax 2019 Tax Return forms for AY 2019 20 notified કંપનીના

Mr Thomson warned of three "golden rules" for claiming work-related expenses: 1. The taxpayer making the claim just have spent the money themselves and were not reimbursed. 2. The expense must.

Here’s everything you need to know about Australian taxes This is Australia

Supporting students year round. If you are under 21 or studying full time (under 25 years) we'll take care of your tax return. For just $79*, our consultants are sharpening their pencils to help you achieve your best possible tax refund. Even if you're an international student, but studying for 6 months or longer, you are usually considered an.

A quick guide to taxes in Australia Australia Property Guides

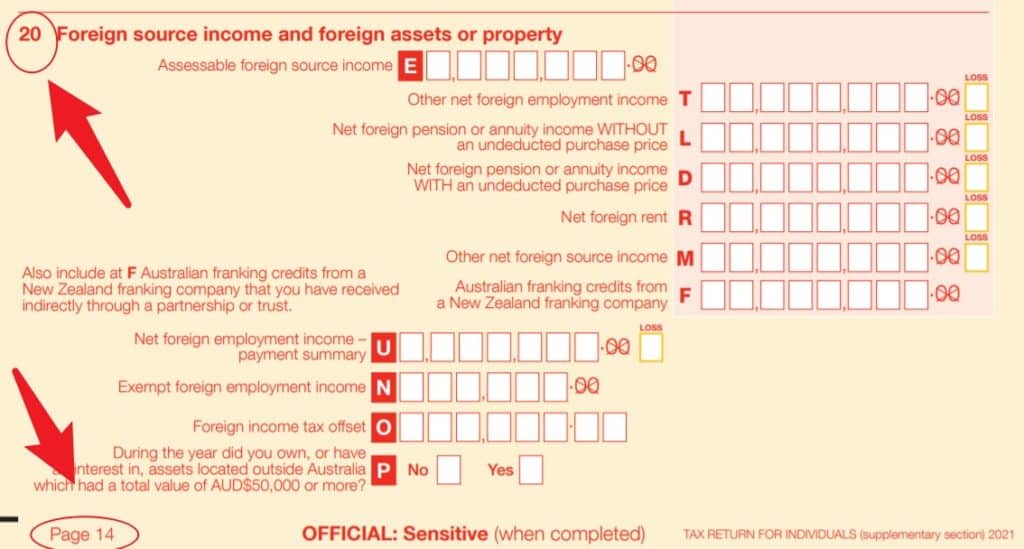

The Australian Tax Office (ATO) collects income tax from working Australians each financial year.. and 2017-18 2018-19 and 2019-20 2020-21*, 2021-22**, 2022-23 and 2023-24 From 2024-25; Taxable income. Your assessable income must be declared on your tax return each year. It includes any of the following: 1. Employment income.

Doordash/Uber eats tax return r/AusFinance

Children's Tax Rates The income tax on children (under 18 years old) is settled according to both the type of income and the status of the child who earned it.. Minors who are Australian residents do not ordinarily have to lodge a tax return if they earn less than $416 within the financial year, unless requested, or if tax has been withheld.

File Australian Tax Return

Tax is a certain amount of money that is given to the Australian government to help pay for government-funded things, for example improving roads or public health care. In Australia, everyone earning more than a certain amount has to pay tax on the money they earn from work, even people who are under 18 years old.

How to prepare tax return Australia 202021 explained YouTube

The young people want their stories heard and to be shown compassion as the bill returns to the Senate for a vote this month. Arad and Pouya arrived in Australia on the same boat in 2012, from the.

Publication Details

There is no need to be concerned as we will fill you in on some of the key information regarding tax returns for under 18-year-olds.

Publication Details

Author: Gregro70s (Newbie) 18 July 2021. Where are the instructions on ATO website for how to lodge a tax return for a child (under 12yo and yes one is required)? Can it be lodged via a child's myGov account or does it need to be a paper tax return? And if paper copy, where is that form?. Authorised by the Australian Government, Canberra.

Fill Free fillable forms for the Australian Tax Office

As she is under 18 and the income is under the taxable income ($18,200), the tax on the fee will be $0. You can check out our Individual income tax rates for further information. @Krngbn. Individual income tax rates. Work income for minors is taxed the same as adults, so $ 1500 is below the taxable limit. Best to get her a TFN, and lodge a tax.

- Bob Jane T Marts Macgregor

- In The Sweet Bye And Bye Hymn Lyrics

- The Leader Of The Bloods

- Tv Shows With Lio Tipton

- American Pitbull Red Nose Terrier

- Dutch Beer Named For A River

- Permanent Living Caravan Parks Gippsland

- Hotel The Taj Vilas Agra Uttar Pradesh

- Redemption The Tookie Williams Story

- Self Service Laundromat Near Me