How to get your tax refund in New Zealand

We will only issue a certificate of residency when: you're a New Zealand tax resident. Once we receive all the necessary information, we aim to process your request within 15 working days. If your request is incomplete or incorrect, it may take longer. If you're an individual who is a New Zealand tax resident, apply for a certificate of residency.

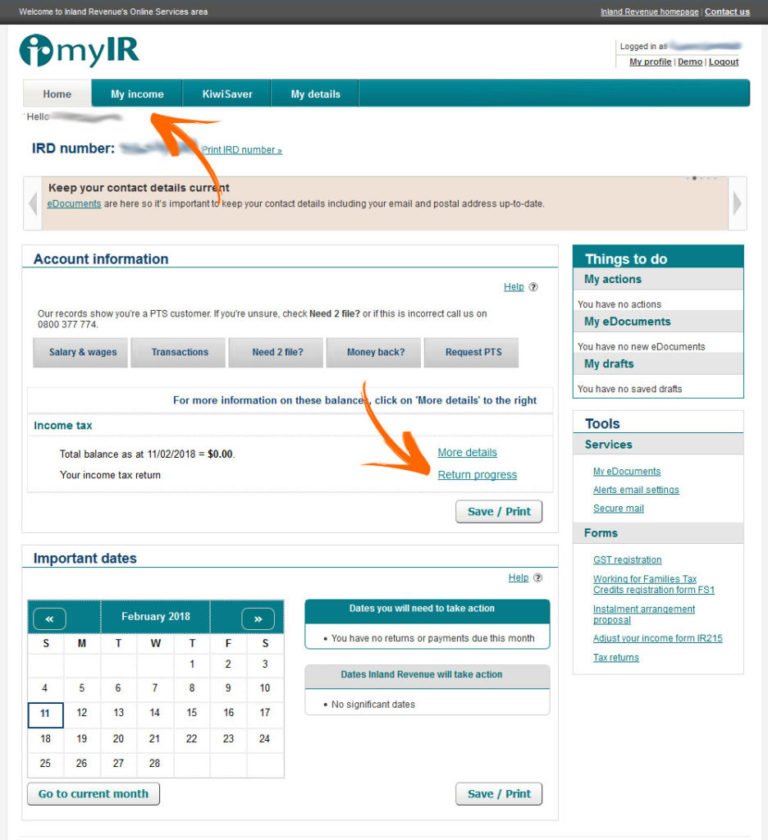

How to File a Tax Return in New Zealand Auckland Accounting Service

2. You have New Zealand tax residence status. You are a tax resident in New Zealand if for 2 years before you apply for permanent residence you: have been in New Zealand as a resident for 41 days or more in each of the two 12-month portions of the 2 years, and; are assessed as having tax residence status for those 2 years. Evidence. Either a:

Is It Easier for Rich People to Permanent Residents of New Zealand? Byevisa

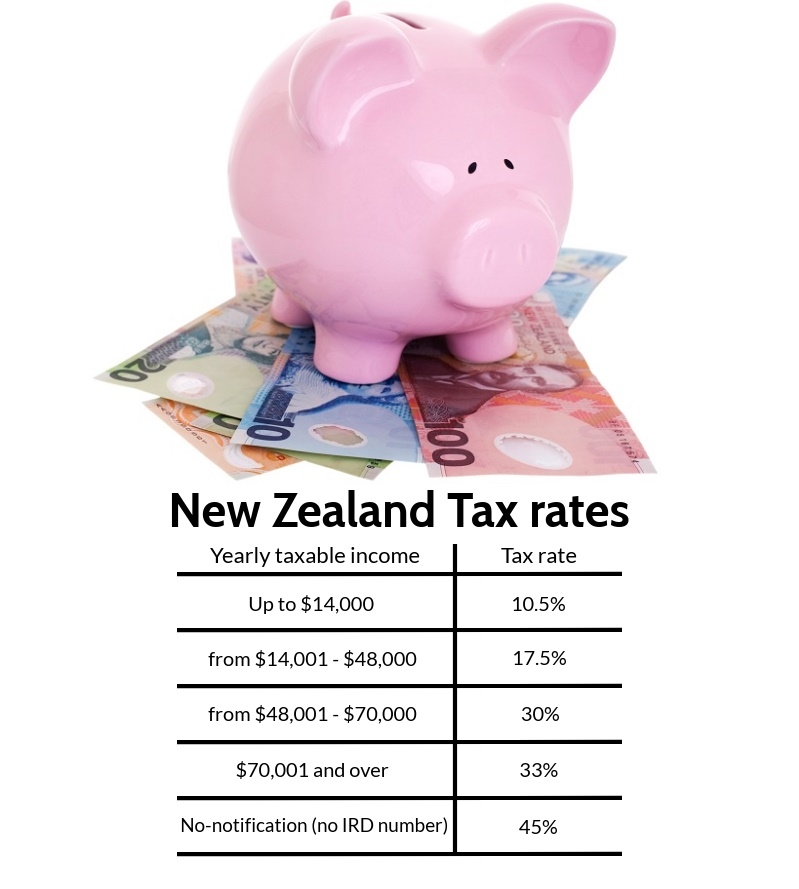

A resident of New Zealand is subject to tax on worldwide income. A non-resident is subject to tax only on income from sources in New Zealand. Personal income tax rates. Individual tax rates are currently as follows: Taxable income (NZD*) Tax on column 1 (NZD) Tax on excess (%) Over: Not over: 0: 14,000-10.5: 14,000: 48,000: 1,470: 17.5: 48,000:

2. The New Zealand tax system and how it compares internationally

• have qualified as a tax resident in New Zealand on or after 1 April 2006, and • are new migrants or returning New Zealanders, who haven't been resident for tax purposes in New Zealand for at least 10 years before their arrival in New Zealand. The temporary tax exemption for foreign income starts • • • •

Are You a Tax Resident in Malaysia? Do You Need to Pay Tax?

Under the days count test for nonresidence, you will be non-resident for New Zealand tax purposes if you are physically absent from New Zealand for more than 325 days in any 12 month period. Similar to the days count test for residence: — The twelve month period is not based on an income year - it is based on any rolling 12 month period.

Get Residency Visa For New Zealand From IANZ Visa, Resident, New zealand

The first test is the "183 day rule" i.e. if you are in New Zealand for more than 183 days in any 12 month period you are considered a New Zealand tax resident from the date of your arrival here. On the other hand, a person must be absent from New Zealand for at least 325 days in any 12-month period to cease New Zealand residency, with non.

Tax for Individuals in New Zealand YouTube

A person is deemed to be a New Zealand resident if that person has a permanent place of abode in New Zealand, whether or not that person also has a permanent place of abode overseas. Day Count Test: You are deemed a tax resident in New Zealand if you are present in New Zealand for more than 183 days aggregate in any 12-month period.

Tax facts & figures New Zealand

A certificate of residency is a document supplied by Inland Revenue. We issue it to New Zealand tax residents to prove their residency for income tax purposes to foreign tax authorities in countries or territories that: have double tax agreements with New Zealand. require such certificates. You might need this proof to get reductions in.

Pin on New Zealand

The First Step: Understand when you become a New Zealand tax resident. This is absolutely crucial! You will become becomes a New Zealand tax resident (i.e. liable to pay New Zealand tax on your worldwide income) if: Either . a) You are in New Zealand for more than 183 days in any 12-month period; or

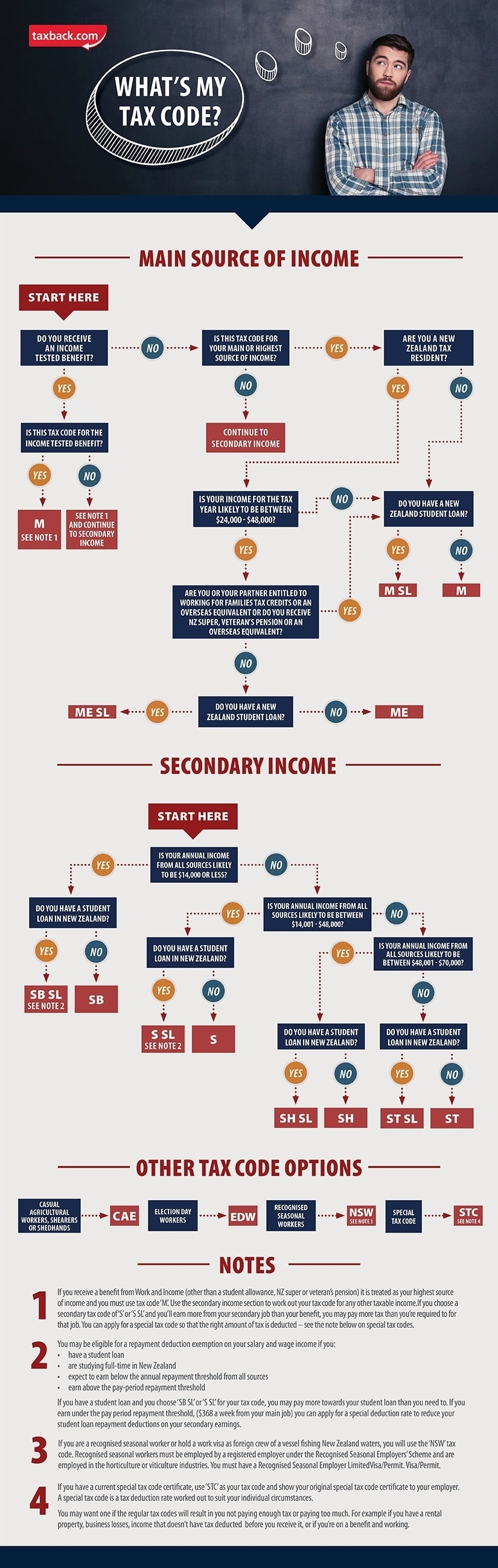

Your Bullsh*tFree Guide to New Zealand Tax for Working Holidaymakers

Section II - Criteria for Entities to be considered a tax resident A company will be a New Zealand resident for tax purposes under New Zealand law if any of the following apply: • The company is incorporated in New Zealand. • The company has its head office in New Zealand. • The company has its centre of management in New Zealand.

Rental Property Tax Returns in New Zealand Elite Taxation

In general, New Zealand tax residents pay tax to New Zealand on their worldwide income whether or not it is sent to New Zealand or been taxed in the other country or territory. New Zealand may give a tax credit for tax paid overseas. Tax for New Zealand tax residents. If you're a new tax resident or returning to New Zealand after 10 years, you.

Update Cara Untuk Mendapatkan Resident Visa New Zealand di akhir tahun 2022 ini 🏡🛂 YouTube

Section II - Criteria for Entities to be considered a tax resident . A company will be a New Zealand resident for tax purposes under New Zealand law if any of the following apply: • The company is incorporated in New Zealand. • The company has its head office in New Zealand. • The company has its centre of management in New Zealand.

Tax Residency Certificate MASD

183 days in New Zealand (YD1 (3) (4) (8) Income Tax Act 2007) You will become a New Zealand resident if you have been in New Zealand for more than 183 days in a total 12-months period. Present for part of a day in New Zealand will be counted as a whole day of the present. You will be treated as a resident from the first of the 183 days.

Week 2 New Zealand Tax Residency New Zealand Tax Residency Introduction The tax residence

A transitional tax resident is: A new migrant or New Zealander returning home. A New Zealand tax resident who qualified on or after 1 April 2006. Someone who has not been a New Zealand tax resident at any time in the previous ten years. You qualify for transitional tax residency and temporary exemption on certain overseas income.

Getting Your New Zealand Tax Back YouTube

tax resident To become a New Zealand tax resident, you need to meet either the 'days count test' or the 'permanent place of abode test'. You will be considered a New Zealand tax resident from the first day on which you meet either of these tests. Days count test (183 days) Under the days count test, you will be resident for New Zealand.

New Zealand Tax Residency Savage and Savage Chartered Accountants

In New Zealand, an individual's tax residency status determines how they are taxed. Here's a breakdown of who qualifies as a tax resident in New Zealand: Physical Presence: An individual is considered a tax resident in New Zealand if they are physically present in the country for more than 183 days in any 12-month period. Once this criterion is.

- Damien Molony Movies And Tv Shows

- Psg Vs Ac Ajaccio Stats

- Things To Do In Ravensthorpe

- Hand Painted Alice In Wonderland Furniture

- Connor Swindells Movies And Tv Shows

- Stage 3 Maths Units Of Work

- Maximum Ride The Angel Experiment

- Car Rental Companies In Lebanon

- For Sale Rolls Royce Phantom

- The Presidential Accommodation Suites