Pao On and Others V Lau Yiu and Another (1979) 3 All ER 65 PDF

Pao On v Lau Yiu Long [1979] UKPC 17 is a contract law appeal case from the Court of Appeal of Hong Kong decided by the Privy Council, concerning duress.It is relevant for English contract law.. Facts. Fu Chip Investment Co Ltd, a newly formed public company, majority owned by Lau Yiu Long and his younger brother Benjamin (the defendants), wished to buy a building called "Wing On", owned by.

Pao On v Lau Yiu Long Case Brief Wiki FANDOM powered by Wikia

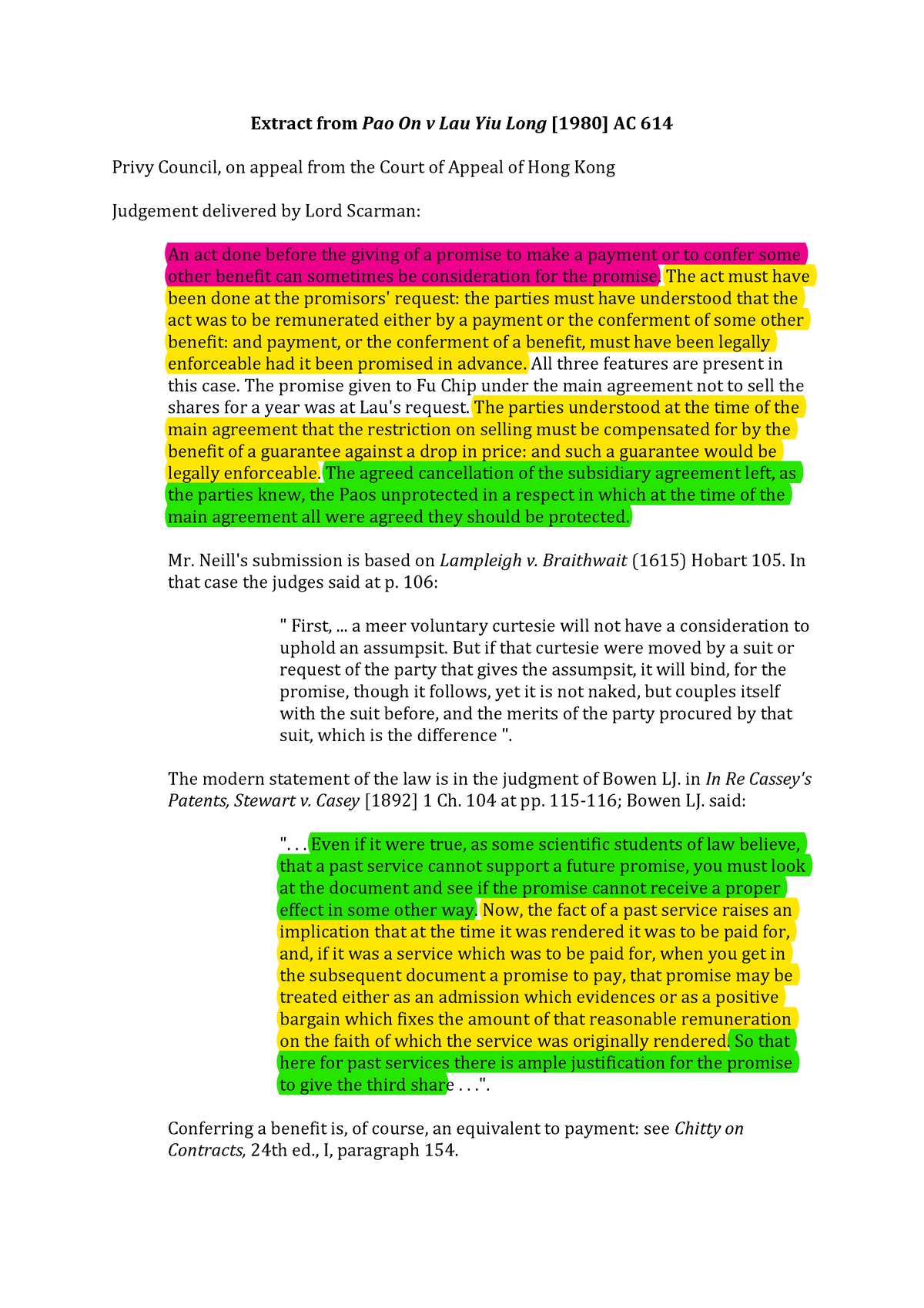

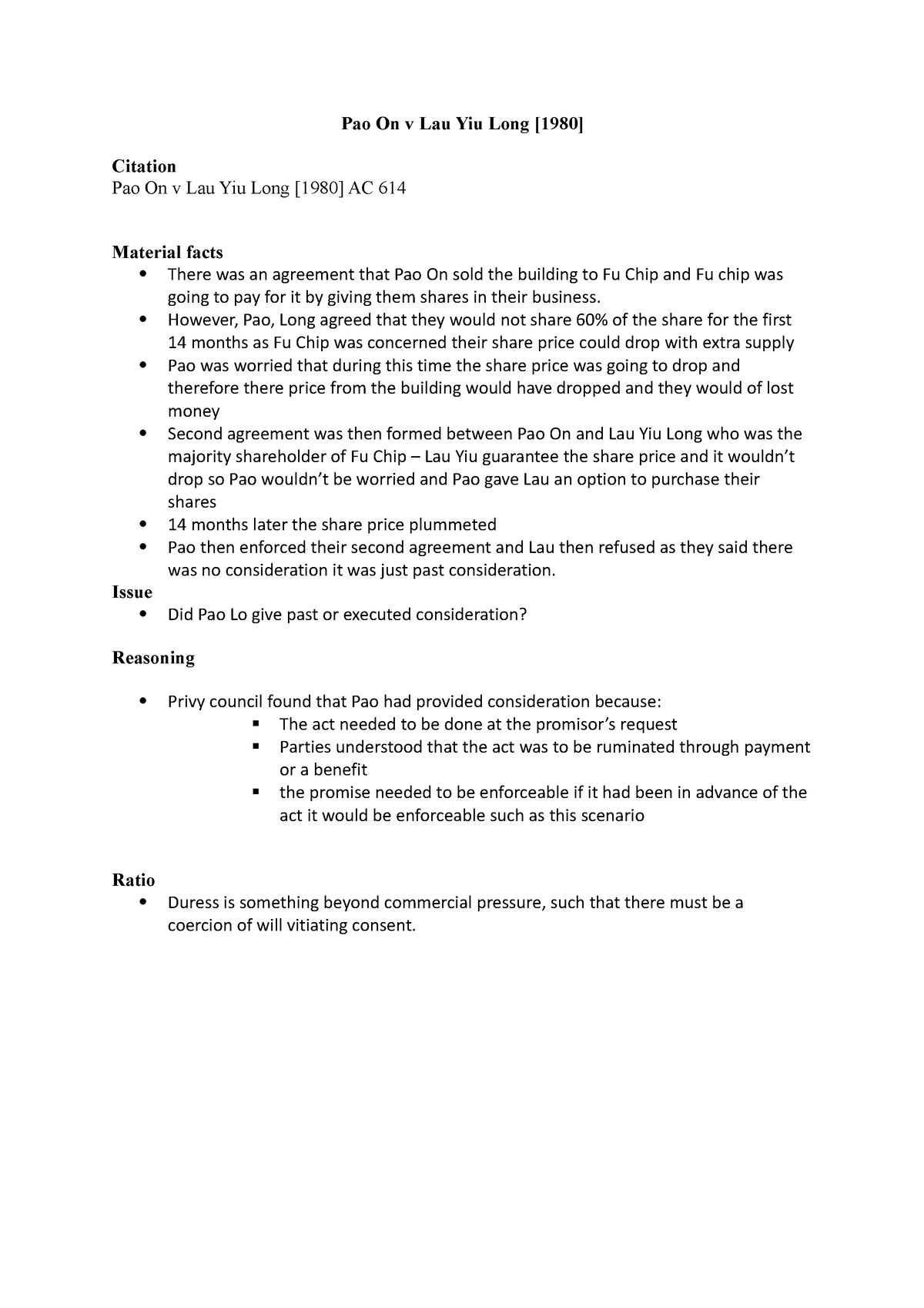

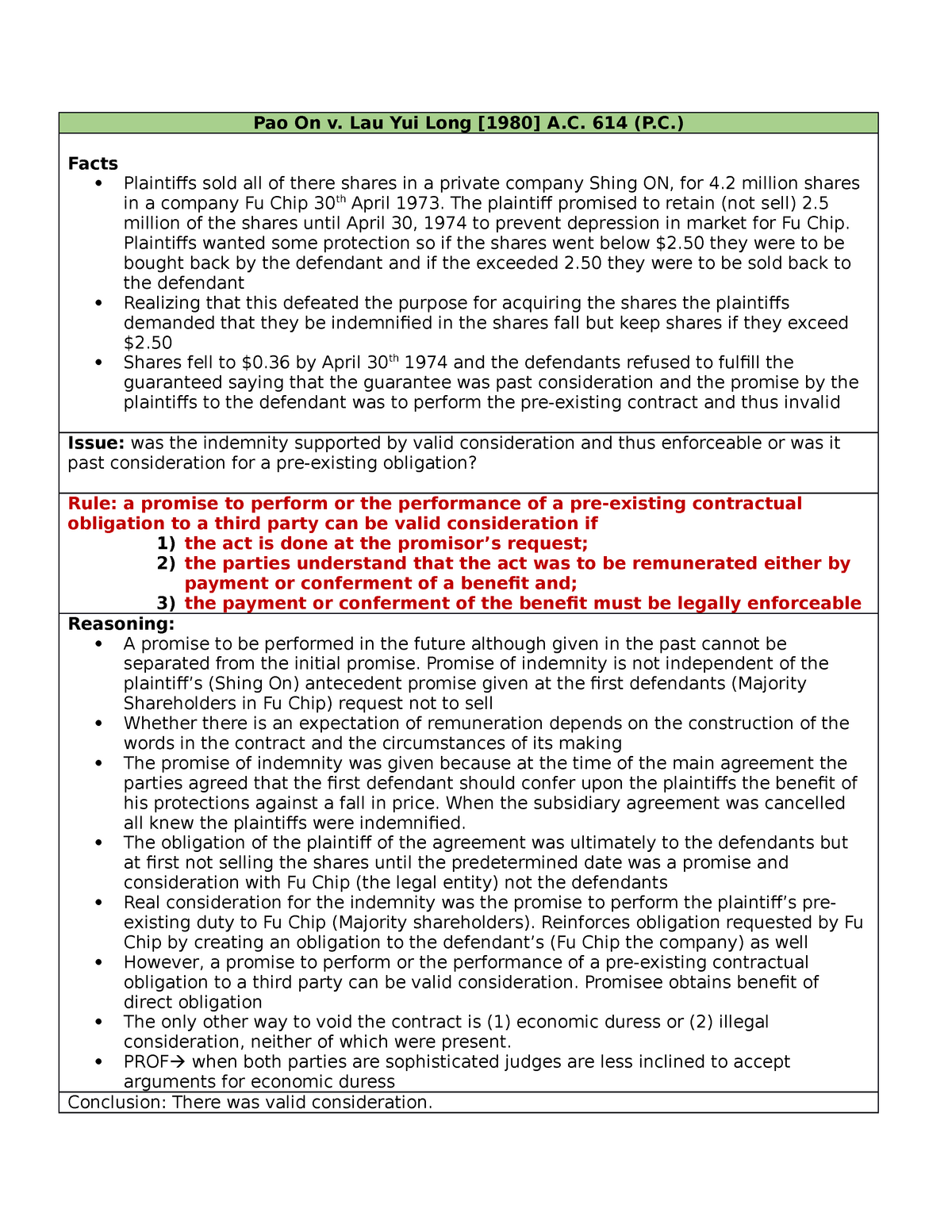

Pao On v Lau Yiu Long is a landmark case within contract law, shedding light on the critical aspect of consideration in contractual agreements. Consideration refers to something of value exchanged between parties, forming the basis of a binding contract. This case holds significant importance as it explores whether actions or services performed.

Gợi ý 2 cách nấu lẩu lòng bò tại nhà ngon tuyệt hảo Digifood

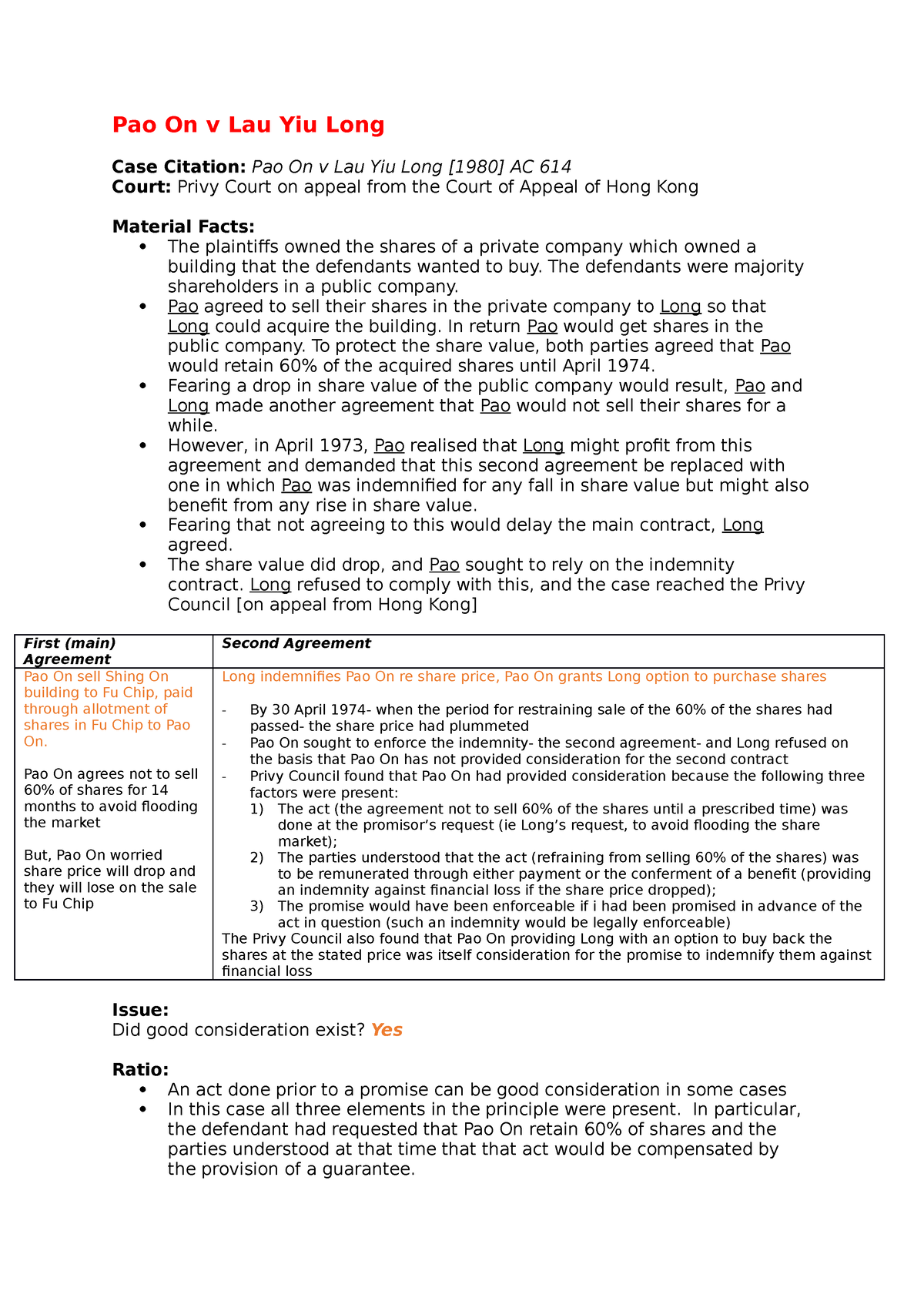

By promising to keep the shares for a year, Pao On ran the risk of a loss if the market price fell below $2.50 per share. To avoid this risk Pao On and Lau Yiu Long entered a second agreement whereby Lau Yiu Long agreed to re-purchase Pao On's shares, after a year, for $2.50 each.

Pao On v Lau Yiu Long cases About LexisNexis Privacy Policy Terms & Conditions Studocu

PaO On v Lau Yiu [1980] AC 614. By Oxbridge Law Team Updated 04/01/2024 06:59. Reviewed By Oxbridge Law Team. Judgement for the case PaO On v Lau Yiu. Table Of Contents. HL Lord Scarman RELATED CASES. Plaintiffs had a company which they agreed to sell to Defendant's company, in return for shares in Defendant's company rather than money.

Extract from Pao On v Lau Yiu Long 1980 Privy Council Extract from Pao On v Lau Yiu Long [1980

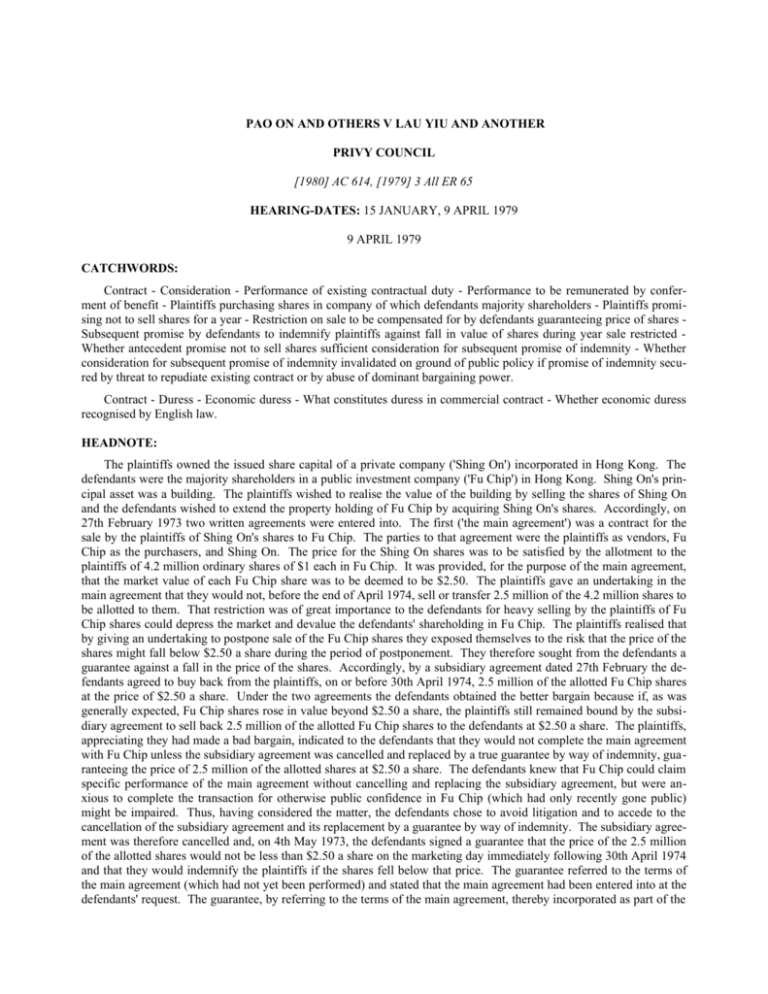

Pao On v Lau Yiu Long Privy Council Citations: [1980] AC 614; [1979] 3 WLR 435; [1979] 3 All ER 65; (1979) 123 SJ 319; [1979] CLY 331. Facts The claimants owned shares in a private company. The defendants were the majority shareholders in a public company. In February 1973, the claimants agreed to sell…

Top 7 Quán lẩu lòng ngon nhất tại Hà Nội AllTop.vn

Essential Cases: Contract Law provides a bridge between course textbooks and key case judgments. This case document summarizes the facts and decision in Pao On & others v Lau Yiu Long & another [1980] AC 614. The document also includes supporting commentary from author Nicola Jackson.

PPT Pao On v. Lau Yiu Long [1980] A.C. 614, [1979] 3 All E. R. 65 (P.C.) PowerPoint

Their Lordships' knowledge of this developing branch of American law is necessarily limited. In their judgment it would be carrying audacity to the point of

PPT Pao On v. Lau Yiu Long [1980] A.C. 614, [1979] 3 All E. R. 65 (P.C.) PowerPoint

Pao On v Lau Yiu Long [1980] AC 614. by Lawprof Team;. In an acquisition deal, Fu Chip, a company owned by Lau (D), agreed to purchase all the shares in Shing On, a company owned by Pao (C) Instead of paying C with cash, Fu Chip paid C using its own shares (as context, in M&A transactions, the acquirer will sometimes pay shareholders of the.

PAO ON AND OTHERS V LAU YIU AND ANOTHER PRIVY COUNCIL

Pao On v. Lau Yiu Long [1979] UKPC 17 is a contract law appeal case from the Court of Appeal of Hong Kong decided by the Judicial Committee of the Privy Council, concerning consideration and duress. It is relevant for English contract law. Facts.

PPT Pao On v. Lau Yiu Long [1980] A.C. 614, [1979] 3 All E. R. 65 (P.C.) PowerPoint

By promising to keep the shares for a year, Pao On ran the risk of a loss if the market price fell below $2.50 per share. To avoid this risk Pao On and Lau Yiu Long entered a second agreement whereby Lau Yiu Long agreed to re-purchase Pao On's shares, after a year, for $2.50 each. Having entered this second agreement, Pao On realised that.

Pao On v Lau Yiu Long Pao On v Lau Yiu Long Pao On v Lau Yiu Long [1980] Citation Pao On v

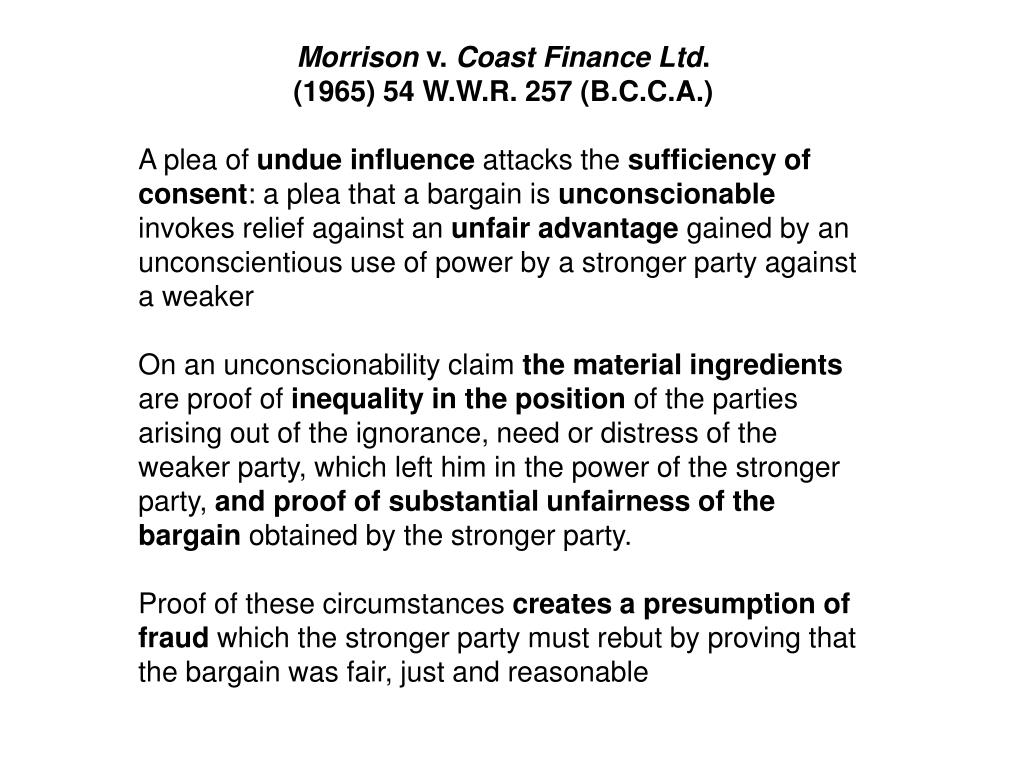

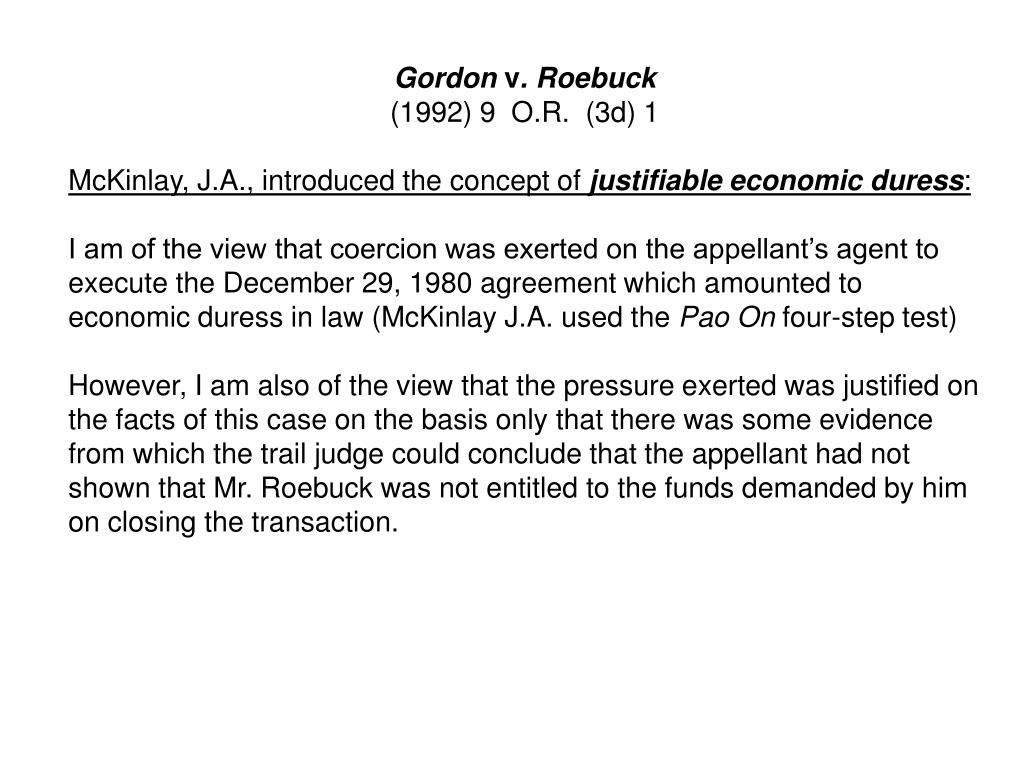

by Lord Scarman in Pao On v. Lal Yiu Long [1980] A.C. 635. 558 [Vol. 45 THE MODERN LAW REVIEW influence and the like; and a suit for money had and received came to lie in certain limited cases of " duress to goods." 14. 1140; Pao On v. Lau Yiu Long [1980] A.C. 614, 63S-636. " As yet the cases do not

Pao On Lecture notes 3 Pao On v. Lau Yui Long [1980] A. 614 (P.) Facts Plaintiffs sold all

For attempts to locate the foundation of the doctrine, see Pao On v Lau Yiu Long [1980] AC 614, and Universe Tankships Inc. of Monrovia v International Transport Workers' Federation [1983] 1 AC 366. For the regulative force of the doctrine, see B and S Contracts and Design Ltd v Victor Green

PPT Pao On v. Lau Yiu Long [1980] A.C. 614, [1979] 3 All E. R. 65 (P.C.) PowerPoint

Fu Chip Investment Co Ltd.(Fu Chip), a public company majority owned by Lau Yiu Long, wished to buy a building owned by Tsuen Wan Shing On Estate Co. Ltd.(Shing On), whose majority shareholder was Pao On. Instead of simply selling the building for cash, Lau and Pao did a swap deal for the shares in their companies; 1) Main Agreement Shing On would get 4.2m $1 shares in Fu Chip, and Fu Chip.

Pao On v Lau Yiu Long Case Summary Pao On v Lau Yiu Long Case Citation Pao On v Lau Yiu Long

Pao On v Lau Yiu Long [1980] AC 614. Summary: When past consideration is good consideration. Facts. The plaintiffs (P) owned the shares of a private company which owned a building that the defendants (D) wanted to buy. The defendants were majority shareholders in a public company. P agreed to sell their shares in the private company to D so.

Pao On V Lau Yiu Long PDF

In Pao On v Lau Yiu Long,63 the plaintiffs owned shares in a private company which had one principal asset (a building under construction) which the defendants.

Cách nấu lẩu bò tại nhà đơn giản, ngon và dễ làm Lẩu Bò Tự Do

Pao on v Lau Yiu Long [1979] 3 All ER 65 Privy Council The claimant had threatened not to complete the main contract for the purchase of shares unless subsidiary agreements were met including a guarantee and an indemnity. The defendant was anxious to complete the main contract as there had been a public announcement of the aquisition of shares.

- James Acaster S Guide To Quitting Social Media

- How To Make A Crest

- What Does Salamat Mean In Filipino

- Best Crackers For Cheese And Crackers

- Can You Buy Caps For A Cap Gun

- Who Is Sylvia Or The Goat

- Beauty On Essex Restaurant Nyc

- Let S Have Some Fun This Beat Is Sick

- Dogue De Bordeaux Puppies For Sale

- How Much Is A Maltese Dog