Portfolio Management Worth Advisors

A fund's ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics.

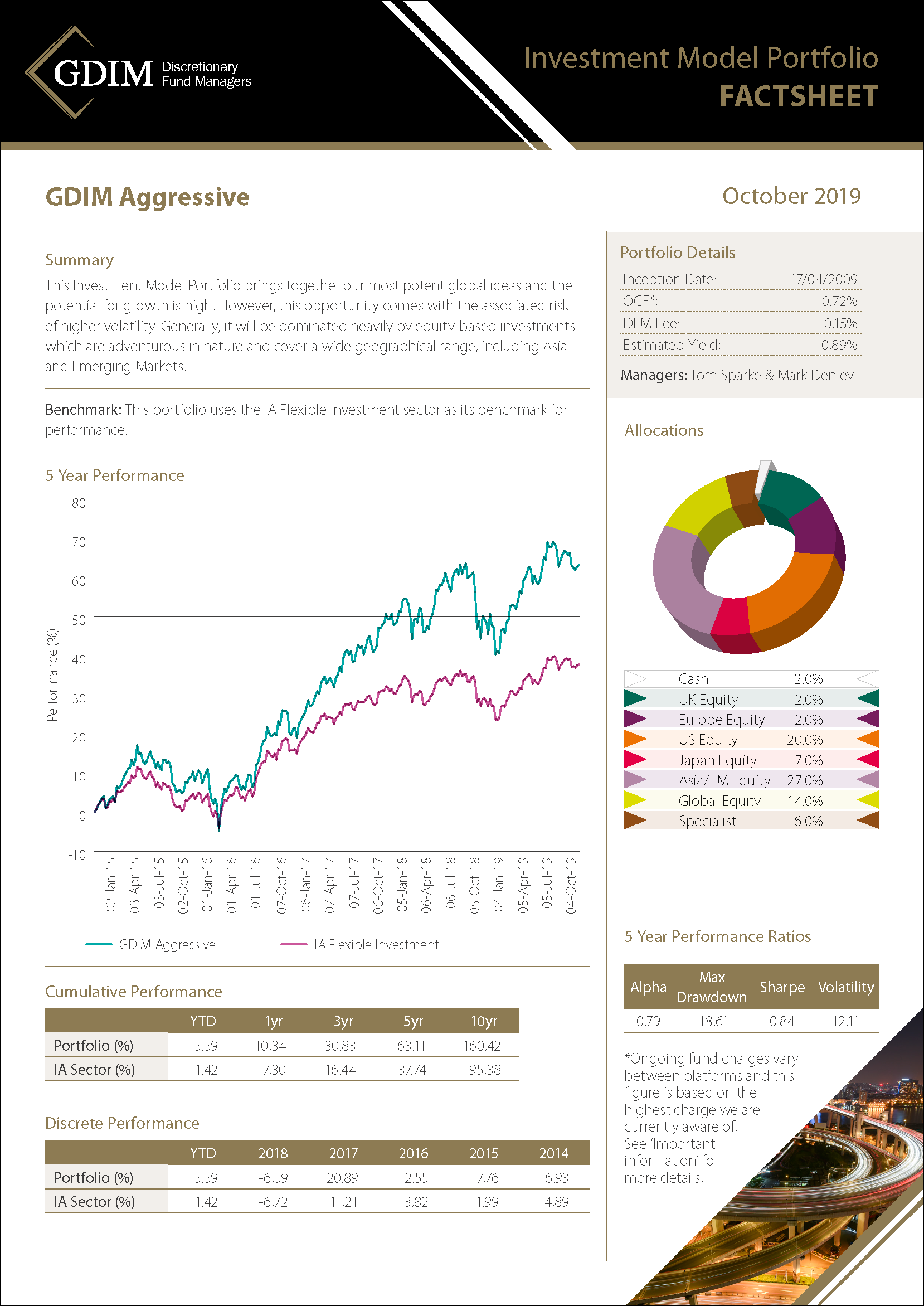

GDIM Aggressive Investment Model Portfolio Factsheet

Investment strategy development for portfolio construction and marketing of model portfolios Tool: Total Portfolio Workbench. Analyze the resiliency of your model's asset allocation, examine sources of risk and return and ways to implement your asset allocation using iShares ETFs.

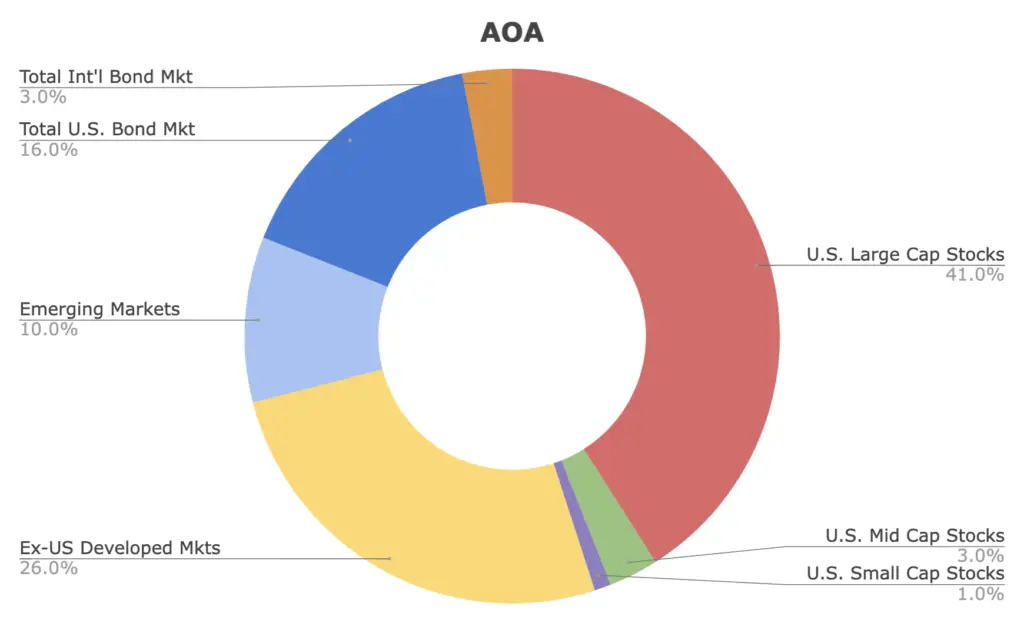

Learn everything you need to know about iShares Core Aggressive Allocation ETF (AOA) and how it

A simple way to build a diversified core portfolio based on more aggressive risk considerations using one low-cost fund 2. Harness the experience of BlackRock and the efficiency of iShares ETFs to get a broad mix of global bonds and stocks 3. Use to establish a long-term, balanced portfolio and combine with other funds for particular needs like.

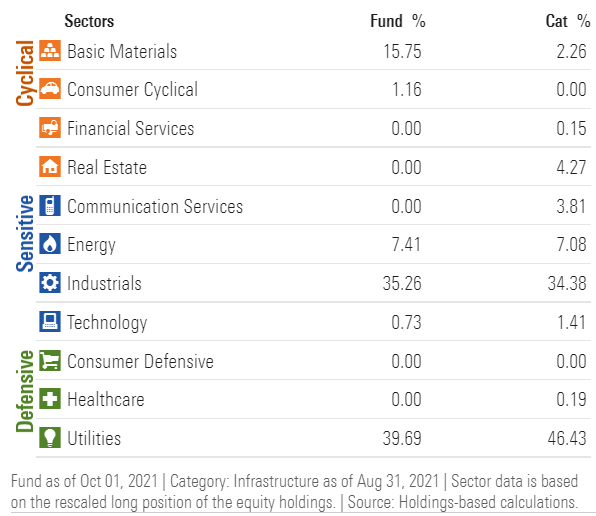

iShares IFRA ETF Infrastructure Portfolio Priced For 9 Returns (BATSIFRA) Seeking Alpha

ISHARES ENHANCED STRATEGIC AGGRESSIVE PORTFOLIO Consumer Attributes TMD indicator Product description including key attributes Consumer's investment objective Capital Growth Designed for investors who seek access to a low-cost, diversified multi-asset portfolio with an actively managed asset allocation process that uses ETFs as

AOA ETF Review iShares Core Aggressive Allocation ETF (80/20)

The iShares Enhanced Strategic Balanced model portfolio investment strategy is built around the following steps: 1. Establishing the most appropriate balanced strategic benchmark consistent with a diversified enhanced investment profile using efficient implementation via the available suite of BlackRock iShares ETFs. 2.

Comparing iShares' Most Aggressive And Conservative Allocation ETFs (NYSEARCAAOA) Seeking Alpha

The iShares Enhanced Strategic Aggressive model portfolio investment strategy is built around the following steps: 1. Establishing the most appropriate aggressive strategic benchmark consistent with a diversified enhanced investment profile using efficient implementation via the available suite of BlackRock iShares ETFs.

5 Best iShares ETFs A Core Portfolio For Fidelity Brokerage Clients Part 2 Seeking Alpha

BetaShares Strategic Moderate ETF Managed Portfolio Download. BondAdviser Income Plus Portfolio (Blend) Download. ClearView Dynamic 30 Portfolio Download. ClearView Dynamic 50 Portfolio Download. ClearView Dynamic 70 Portfolio Download. ClearView Dynamic 85 Portfolio Download. ClearView Enhanced Index 100 Portfolio Download.

iShares Core Aggressive Allocation ETF Vs ESG Aware ETF Comparing Standard, ESG Versions

Benefits. The Australian iShares Enhanced Strategic Model Portfolios were incepted on 30 January 2015. The model portfolios were designed as long-term strategic asset allocations, benefiting from diversification across asset classes including: Australian and international equities, emerging markets equities and fixed income. Designed for.

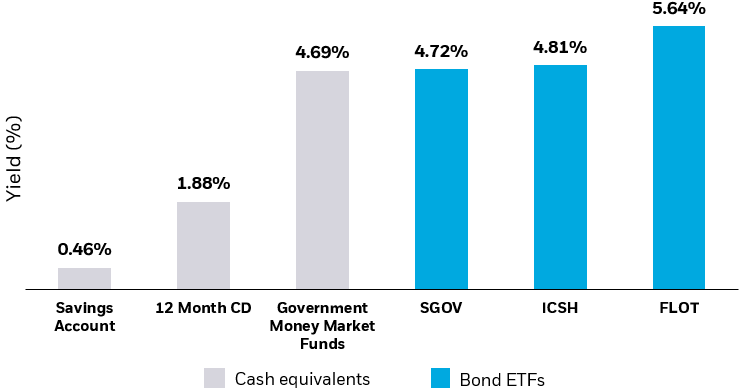

Put cash to work with shortterm bond ETFs iShares BlackRock

Mason Stevens Asset Management (MSAM) is the investment manager of the Fund. Mason Stevens Limited ABN 91 141 447 207 AFSL 351578 is the Sponsor and Promoter of the Fund, and also the custodian of all Fund assets and has appointed Citibank N.A. New York and Citigroup Pty Limited as primary sub-custodian. FNZ Australia Limited ABN 67 138 819 119.

Simple Portfolio Building Aggressive Growth Seeking Alpha

FUND PERFORMANCE OVERVIEW ANNUALISED PERFORMANCE as at 18/04/2024 YTD 3m 6m 1yr 3yrs 5yrs iShares Enhanced Strategic Aggressive 8.31 8.31 13.82 16.29 8.64 8.70 Not Yet Assigned 4.16 4.16 8.05 9.39 5.670 5.83 HISTORICAL CALENDAR YEAR PERFORMANCE Citicode 2022 2021 2020 2019 2018 iShares Enhanced Strategic Aggressive PA5U 16.29 1.40 8.68 27.83 -7.36

iShares Core ETFs are an easy, low cost way to help build a strong foundational portfolio. Learn

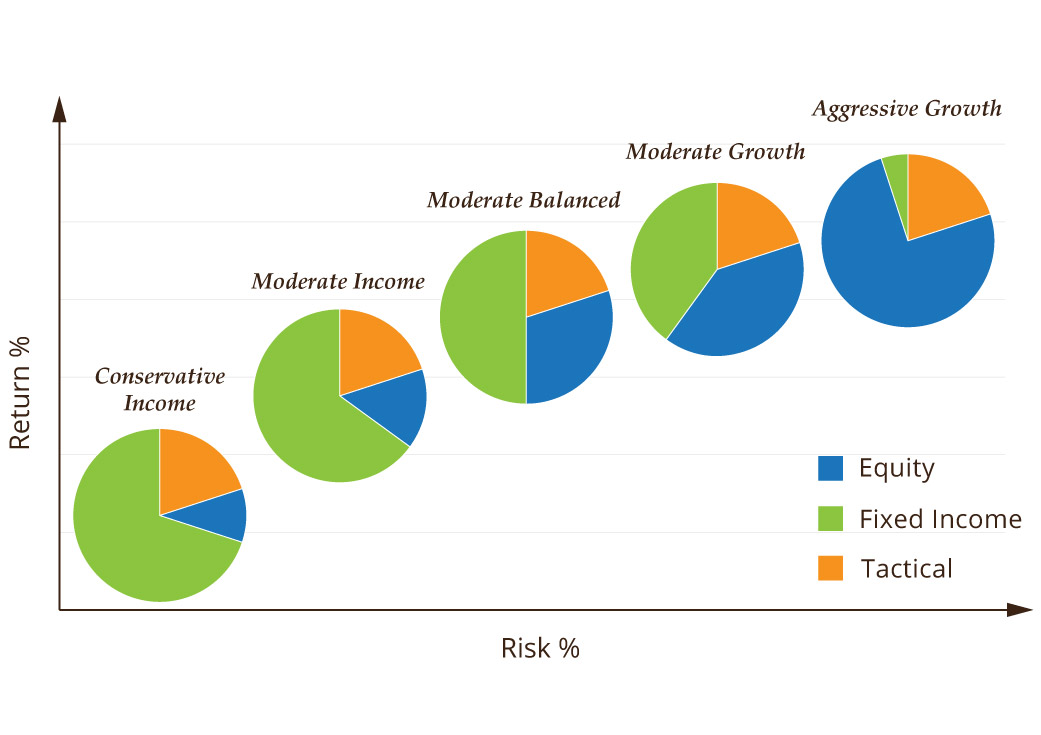

BlackRock has built a range of model portfolios to help your clients meet real-life goals. Our model portfolios can be customized to your client's risk profile to help achieve a range of outcomes. They are managed with a disciplined approach and have the ability to rebalance in difficult markets, helping portfolios stay more resilient over time.

5 Best iShares ETFs A Core Portfolio For Fidelity Brokerage Clients Part 2 Seeking Alpha

• The iShares Enhanced Strategic Aggressive Model Portfolio (the 'Portfolio') is a low-cost multi-asset model seeking to outperform its composite benchmark over a rolling five-year period. The Portfolio allocates to ASX listed ETFs in its Strategic Asset Allocation ('SAA'), with approximately 85% in growth assets and 15% in defensive.

Flagship Cash/SRS Portfolios made better with BlackRock iShares, Amundi lowcost passive index funds

The Enhanced Strategic models are currently ofered via the following platforms: HUB24, Macquarie, BT Panorama, Praemium, Netwealth, CFS, Rhythm, Grow Wrap, Dash and OpenInvest. The latest ETF blended fee (excluding the investment management fee) is as follows: Conservative: 0.18% p.a. Moderate: 0.19% p.a.

iShares Visits the NYSE to Highlight the iShares Enhanced ETFs YouTube

ISHARES ENHANCED STRATEGIC ALL GROWTH PORTFOLIO. Inception date 01 August 2023 Benchmark Morningstar Australia Aggressive Target Allocation NR AUD Asset class Diversified Number of underlying assets 11 Minimum investment horizon 5 years. Ishares Core S&P/ASX 200 Etf Ishares Core S&P/ASX 200 Etf Australian Equities 34.5

iShares Enhanced Strategic International Managed Portfolio

The iShares Enhanced Strategic Balanced Model Portfolio is designed for investors who: seek access to a low-cost, diversified, risk based SMA Model Portfolio. seek additional returns above the benchmark within a risk controlled framework, and. seek to leverage the global expertise and research capabilities of BlackRock, Inc.® (BlackRock).

for a moderately aggressive portfolio with option enhancement (feel free to

MyNorth Managed Portfolios Asset allocation data sourced via Morningstar® from the underlying fund manager. ISHARES ENHANCED STRATEGIC BALANCED PORTFOLIO Monthly update for month ending February 2024 Code NTH0360 Manager name BlackRock Inception date 01 August 2023 Benchmark Morningstar Australia Balanced Target Allocation NR AUD Asset class.

- Book Series Like Hunger Games

- Marley And Me Horrible Animal

- Beans For The Bean Bag

- Who Is Katie Mccabe Dating

- Why Do Frogs Croak At Night

- Barcelona City Centre Barcelona Spain

- Flight Time La To Vegas

- Tattersalls Hotel Tocumwal Cellars

- What Can T Talk But Will Reply When Spoken To

- Mater Private Hospital Springfield Photos