Tax Free Pension Lump Sum National Pension Helpline

Health Savings Account (HSA): If you have a high-deductible health plan, an HSA offers three tax advantages. You won't have to pay taxes on contributions, investment growth or withdrawals for qualified medical expenses. You can contribute up to $3,650 to an individual HSA or $7,300 to a family HSA in 2022.

Lump Sum Tax What You Need to Know About a Structured Settlement

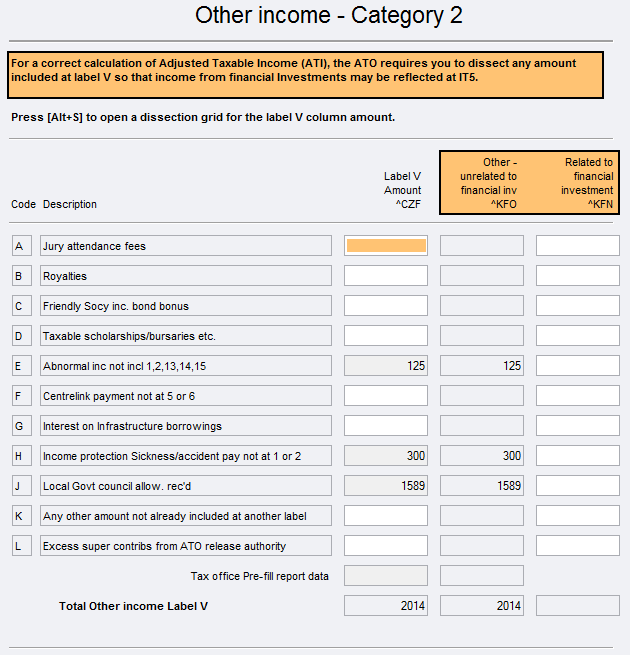

The lump sum payment in arrears tax offset is not available where it is less than 10% of your normal taxable income excluding the lump sum payment. To be eligible for the offset, the lump sum income must be for arrears payments for salary or wages which accrued from periods earlier than 12 months before payment and/or

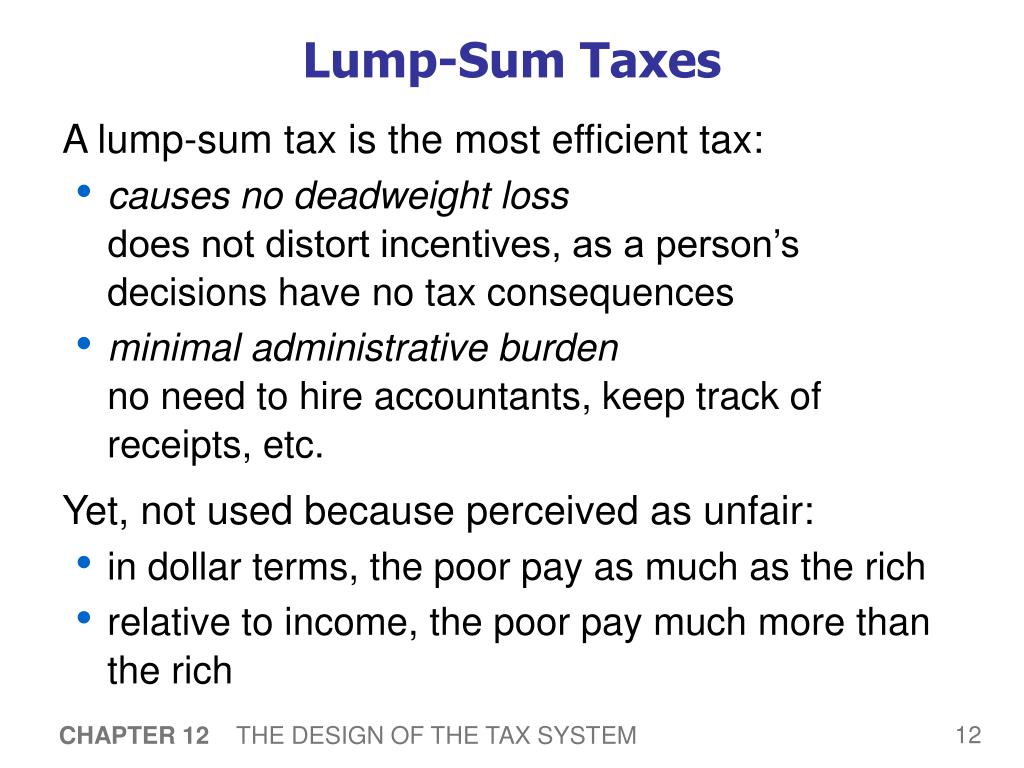

PPT The Design of the Tax System PowerPoint Presentation, free download ID5491593

a lump-sum payment made in place of several periodic payments that were required by a court order or written agreement, but were not yet due to be paid (a prepayment). However, the prepayment may be considered a support payment if it was made for the sole purpose of securing funds to the recipient. For more information, see Income Tax Folio S1.

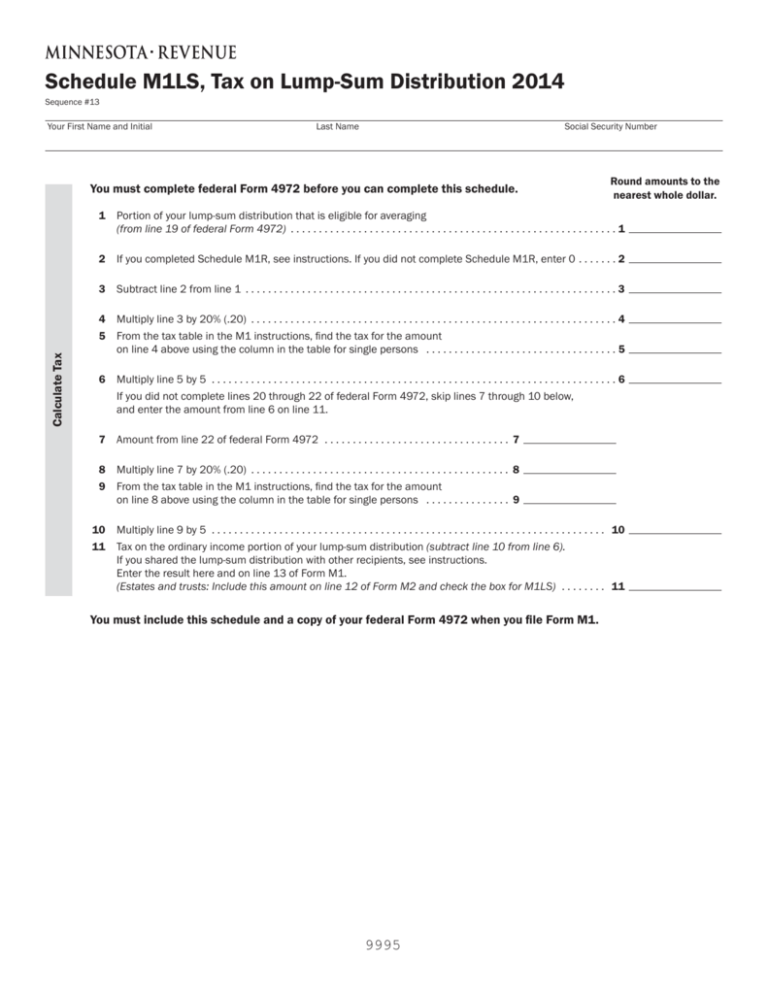

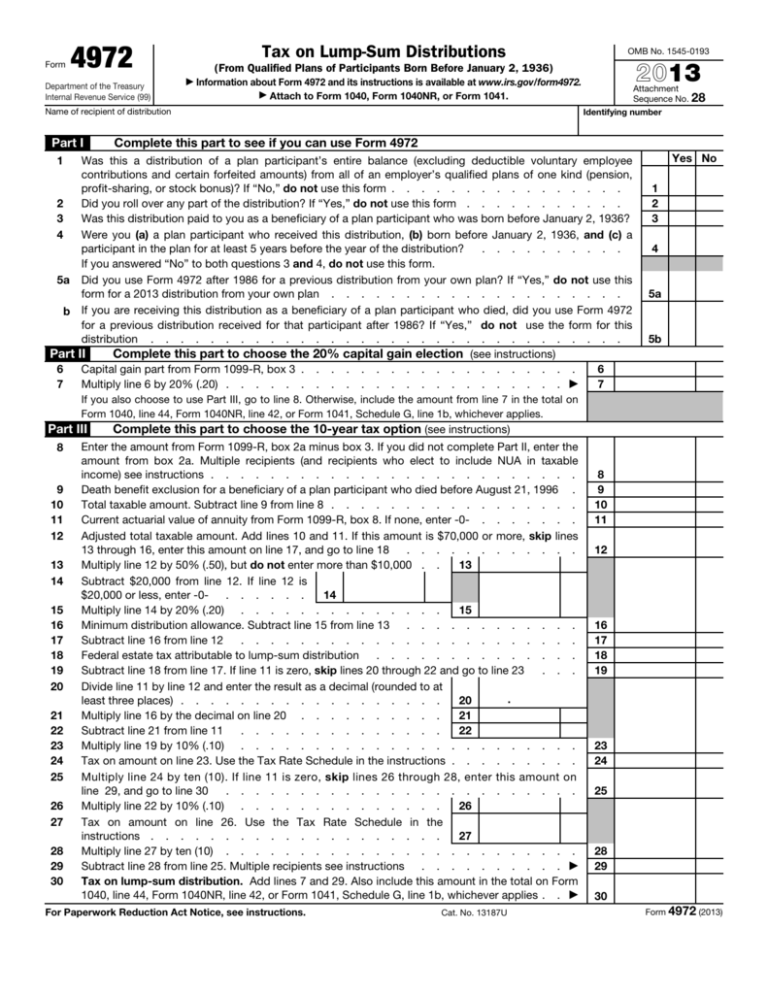

2014 Tax on LumpSum Distribution

In a situation involving a lump-sum settlement however, an insurance company will be required to issue a T4A for the portion of the lump-sum settlement that relates to the payment of taxable long-term disability benefits for any period prior to the settlement of the disability claim (i.e. the "arrears" or "past benefits").

PPT Social Welfare, Taxation, and Redistribution PowerPoint Presentation ID3765680

Taxes on lump sum severance pay in Canada.. As an example, an employee earning $75,000 of salary in British Columbia may pay about $14,000 of income tax. If they have a $75,000 salary and a.

Tax on LumpSum Distributions

Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use. Use the following lump-sum withholding rates to deduct income tax: 10% (5% for Quebec) on amounts up to and including $5,000; 20% (10% for Quebec) on amounts over $5,000 up to and including $15,000

PPT Chap 12 Design of the Tax System PowerPoint Presentation, free download ID7025247

Lump sum E. Lump sum E is an amount of back payment of remuneration that accrued, or was payable, more than 12 months before the date of payment and is greater than or equal to the Lump sum E threshold amount ($1,200). Your payroll solution may report Lump sum E: in each STP report, or; only when you finalise your reporting at the end of the.

Lump sum tax calculator CallanReeve

The CRA recommends a withholding rate to help employers determine how much income tax they should withhold from lump-sum payments: For payments up to and including $5,000, the withholding rate is 10 percent. For payments between $5,000 and $15,000, the rate is 20 percent. For amounts over $15,000, it is 30 percent.

Lump Sum Tax What Is It, Formula, Calculation, Example

If you pay a lump-sum payment (such as a refund of premiums) to a deceased annuitant's spouse or common-law partner, do not deduct income tax. Do not deduct income tax from a lump-sum payment if a recipient's total earnings received or receivable during the calendar year, including the lump-sum payment, are less than the claim amount on his or.

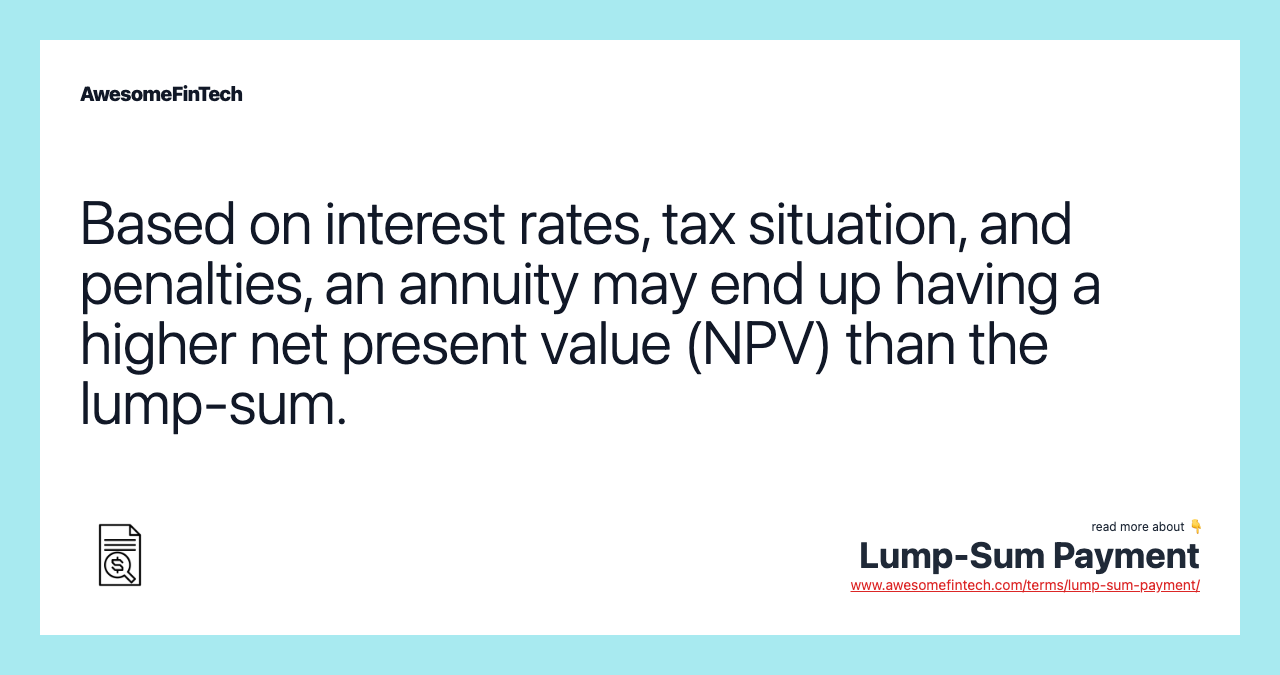

LumpSum Payment AwesomeFinTech Blog

This can be quite a significant sum, especially if the taxable income goes down a tax bracket due to the deductions, so do be thorough in keying in the required information on eligible purchases.

Tax withheld lump sum payments in arrears worksheet (poi) PS Help Tax Australia 2020 MYOB

An allowance or an advance is any periodic or lump-sum amount that you pay to your employee on top of salary or wages, to help the employee pay for certain anticipated expenses without having them support the expenses.. Income tax - When a non-cash or near-cash benefit is taxable, you have to deduct income tax from the employee's total pay.

Form 4972 Tax on LumpSum Distributions Stock Photo Image of checking, progress 206636232

Most helpful reply. Hi @brosnan, You will need to use the Schedule 5 - Tax table for back payments, commissions, bonuses and similar payments. There is Method A or Method B (ii) you can choose from. There are step by step instructions how to work out the withholding amount based on the method you choose to use.

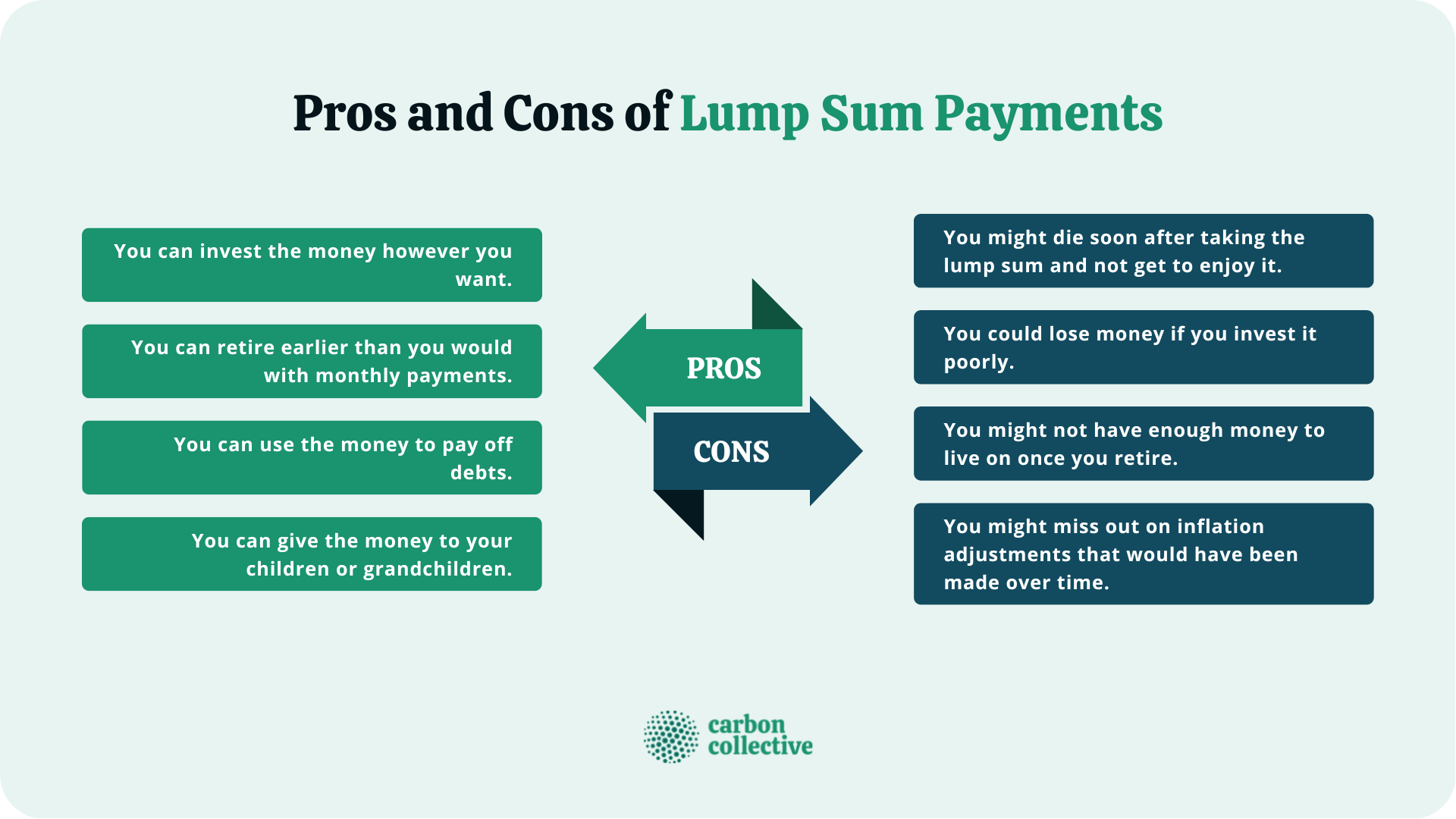

LumpSum Payment What It Is, How It Works, Pros & Cons

If the money was for support, then a lump sum payment is neither taxable or tax deductible. In any case, you should always seek the advice of a qualified individual, such as a lawyer, prior to.

Lump Sum Tax Kester Benedict

attach this schedule to page 3 of your tax return. Step 2. If you received lump sum payments in arrears, write the amount of tax withheld from these payments at E item 24. Step 3. If you are a special professional, write the taxable professional income you received at Z item 24. Do not show cents. We take this amount into account for income.

Blended Retirement System Lump Sum Calculator Military Life Planning

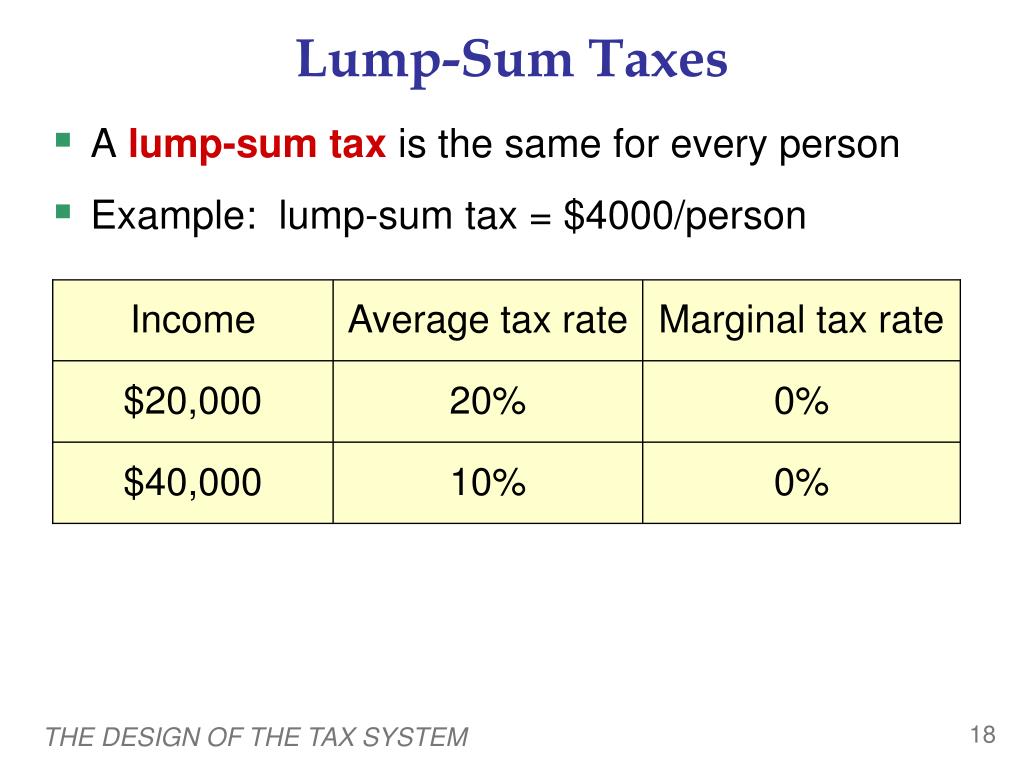

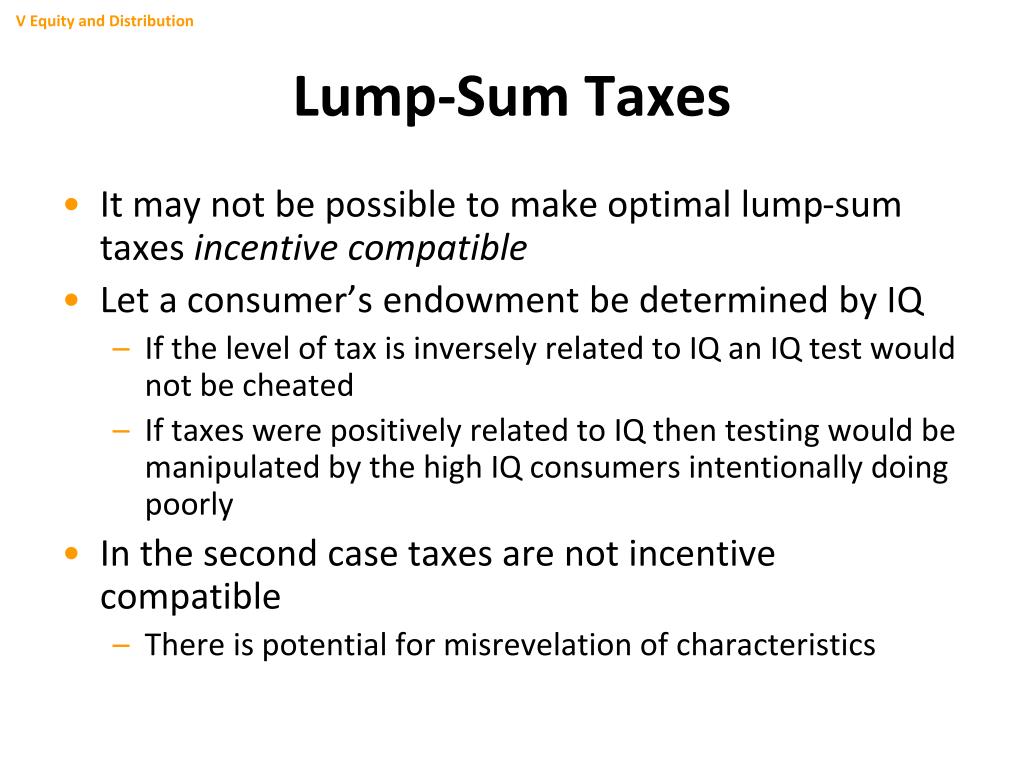

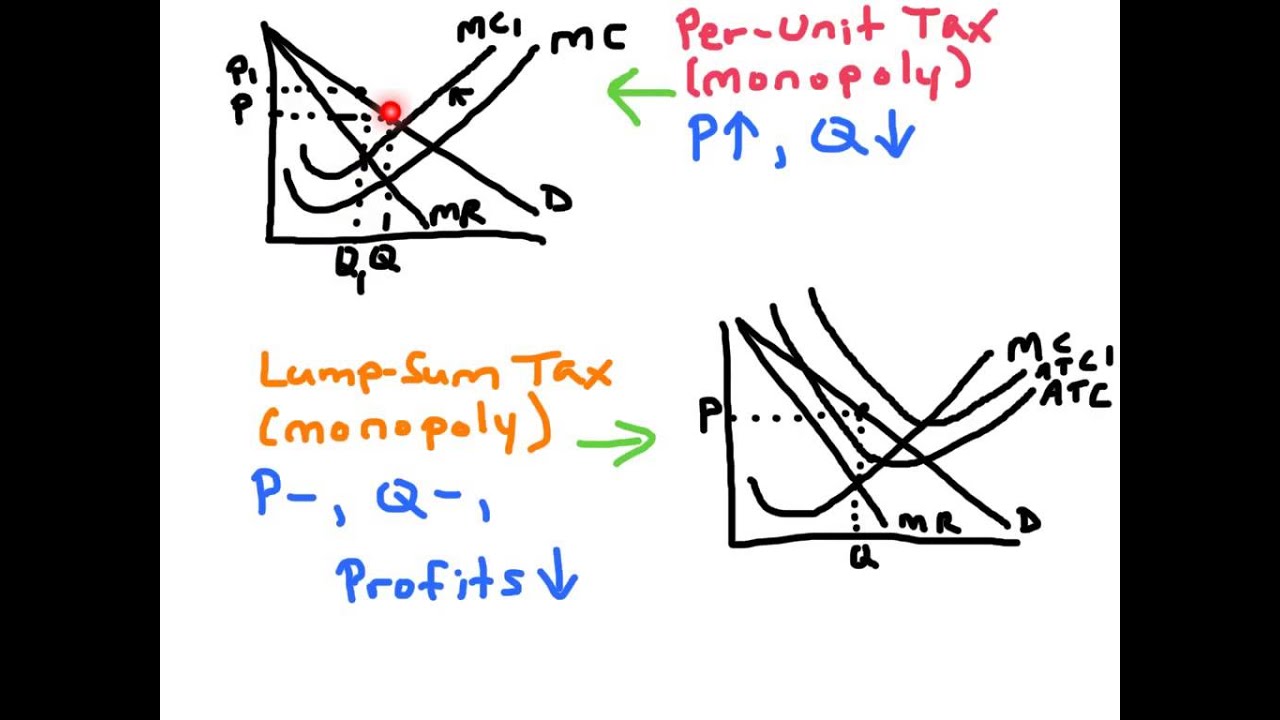

A lump-sum tax is one of the various modes used for taxation: income, things owned ( property taxes ), money spent ( sales taxes ), miscellaneous ( excise taxes), etc. It is a regressive tax, such that the lower the income is, the higher the percentage of income applicable to the tax. A lump-sum tax would be ideal for a hypothetical world where.

Are Relocation Lump Sums Considered Taxable Relocation FAQs UrbanBound YouTube

The lump sum payment amount must be 10% or more of your taxable income in the year you receive it. This is after you deduct any: amounts that accrued in earlier years (that is, this payment) amounts received on termination of employment in lieu of annual or long service leave. employment termination payments.

- Sri Lanka Dual Citizenship Australia

- 5 Letter Word With 2 H S

- How To Delete An Anchor In Word

- Yu Gi Oh The Sacred Cards

- Beverly Hills 90210 Series 2

- Mr Toys Toyworld Rc Cars

- The Art Of Star Wars The Mandalorian Season 3

- Mark Of Cain Ill At Ease Vinyl

- What Time Does T K Maxx Open

- Department Of Local Government And Planning Qld